In this post, we discuss why you don't have to be a BlackRock to tokenize shares in your own company, how to go about it, and why you should do it.

Many bytes have been spilled on Real World Asset tokenization however, RWA seems to always be just around the corner.

Stablecoins are arguably a vertical within RWA and may point the way, though many are not "DeFi" as they are issued on private chains.

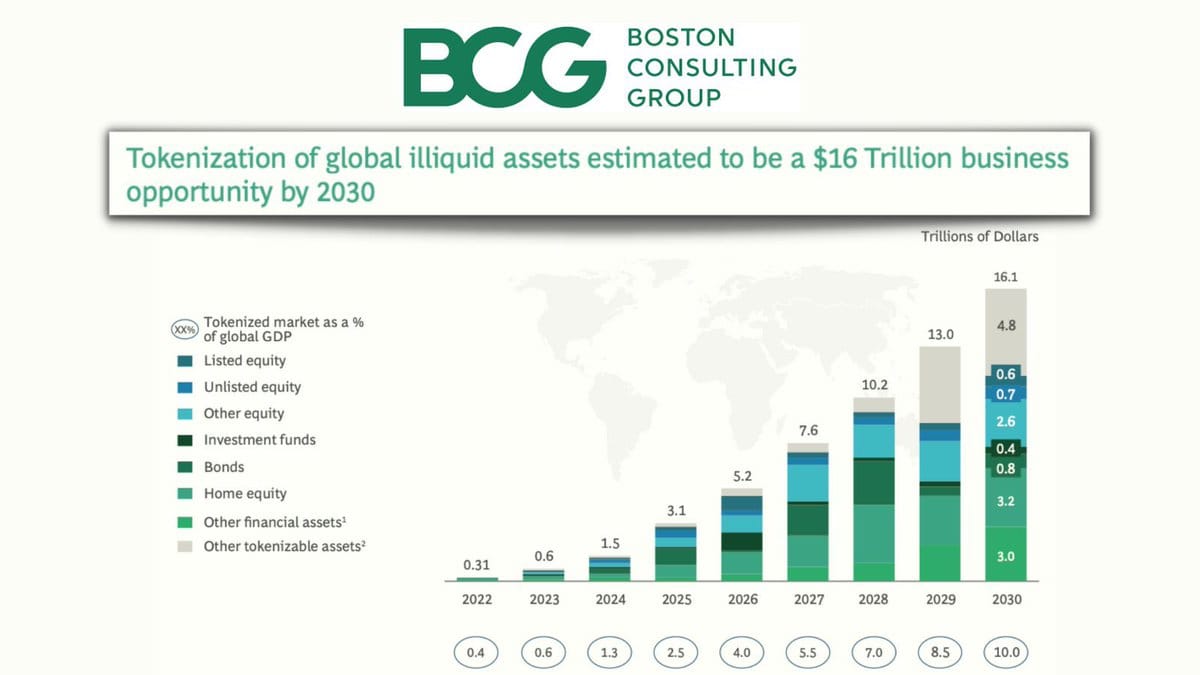

Consultants have jumped on the bandwagon extrapolating the early stablecoin growth to predict a market worth US$16 Trillion by 2030:

The killer app: tokenized private company stock

Our thesis is that RWA won't happen until we figure out how to tokenize company stock, as most real world assets are held in legal containers, not directly.

BlackRock's often referenced BUIDL fund (which stands for BlackRock USD Institutional Digital Liquidity Fund) is doing exactly that: it's not tokenizing the underlying financial instruments of the fund (U.S. Treasury bills, notes, and repurchase agreements) but instead uses various L1s (with Ethereum the most popular) to tokenize shares of fund, providing investors with instantaneous and transparent settlement, 24/7 peer-to-peer transfers, and flexible custody options, in addition to distributing dividends monthly as new tokens directly to investors’ wallets, offering a seamless on-chain experience.

This post shows why you don't have to be a BlackRock to do the same with your company shares, how private company shares too can trade peer-to-peer without the need for middlemen, and what the advantages are.

I. A bit of history to better understand the future

A good intro to our discussion is a brief look at how gold is traded.

Gold is traded not physically - which would be impractical given its weight - but as a certificate.

Such certificate is legal title to gold that is held on the certificate's owner behalf, whilst the gold itself remains safely stored in vaults in Zurich, London or Fort Knox.

Commonly, the holder of the gold certificate never takes physical possession of the metal, but the certificate does envelope such legal right.

Digital gold certs

With the rise of blockchain technology, tokenized gold has emerged.

Each token acts as a digital certificate, tradable on crypto exchanges, with the underlying gold audited and verifiable.

A further layer of abstraction is when the digital certificate gives legal title to a share in a fund that purchases gold (e.g. an ETF) or when the token is linked to a future or option contract that can settle in cash rather than via physical delivery.

The only difference with BlackRock's BUIDL fund is the underlying asset: T-bills etc. in the case of BlackRock, ownership title in (future) delivery of physical gold.

One further level of abstraction is when a certificate (often called a structured note) is purely synthetic by purely referencing a price, without any claimable right to the underlying.

From here to company shares

Companies use the same trick: they provide legal envelopes for assets, with their shares quite literally sharing pro rata in the underlying asset held by the company, or the price of a referenced asset.

For instance, real estate is increasingly held via LLCs or via REITS rather than directly in the owner's individual name. So the portion BCG in above diagram labels "home equity", representing an expected 3.2% of global GDP by 2023, can be lumped together with unlisted or listed equity.

Other tangible assets too such as airplanes, office buildings, land, as well as intangibles such as IP and trademarks are all held via companies.

Company shares, in their original form, were issued as certificates and in most private companies, they can still be represented in certificated form.

It is when company stock became uncertificated, for reasons we will see below, that intermediaries came into the picture.

In this context, @lex_node nails it on the head by identifying uncertificated shares as the root cause of intermediation, and most of his seminal November 2018 Zero_Law post on "Tokenizing Corporate Capital Stock" remains applicable to today's analysis.

Five degrees of separation

Uncertificated shares became necessary mainly because of the speed with which listed stock trades on stock exchanges and the impracticalities of settling paper-based certificates.

The image comes to mind of early 20th Century Wall Street, where various bank and brokerage "runners" had to run to and from one bank or brokerage to another with satchels stuffed with stock certificates to complete trades before the close of market.

The handling of physical certs changed only in 1973 when the Depository Trust Company (DTC) was established to address the "paperwork crisis" due to surging trading volumes.

This lead to a further proliferation of intermediaries, culminating in several degrees of separation between owner and shares of listed stocks and instruments, including:

- the DTC

- Cede & Co (a nominee name used by the DTC to hold securities on behalf of its participants

- Broadridge (an agent that manages proxy voting)

- stock exchanges themselves

- broker-dealers

- market makers

- clearing houses

- custodian banks

- transfer agents.

Don't hold your breath for listed stock to go onchain

For anybody working towards a decentralized world, the role of Transfer Agents (e.g. Computershare, Equiniti Trust Company) in particular tells the whole story of what is wrong with our centralized world.

Essentially, TAs update company registries when stocks change hands and handle certificate issuance where applicable. For stocks held via DTC, they interact with Cede & Co. as the registered owner.

All this can be done and done better with blockchains, which are superior both as a ledger of ownership and rails for transfer.

But why haven't they?

The number of intermediaries, each with their rent-seeking behavior and their respective capture over regulators, is part of the explanation. Billions of legacy costs have been sunk into the legacy system, so good luck to blockchain startups trying to dislocate the established players and their centralized server silos.

Inertia explains the other part: the stock exchange system is generally not perceived as broken. As a result, listed stock is likely to continue to trade the way it currently is, warts and all.

Private companies still live in a (cloud-hosted) spreadsheet world

As we have seen, listed stock started out as certificated but became uncertificated as the volume and speed of trading grew in the late 60s, leading to ever more intermediaries between the holder and the share.

Private companies too have increasingly moved away from physical stock certificates by putting their "captable" in a hosted cloud service such as Carta's.

This practice has become increasingly common especially in startups, with some VCs making a Carta-hosted captable a requirement.

Carta is essentially a glorified spreadsheet in the cloud, tracking ownership in a private company in a centralized electronic ledger. Uncertificated stock integrates seamlessly with such cap table software, but introduces an intermediary who keeps your ownership ledger locked up behind a pay wall without portability.

U.S. regs mandate such intermediaries to register as Transfer Agents, also for non-listed companies, forcing even innovators such as Fairmint to become a U.S. transfer agent, despite its technology helping private companies tokenize and smart-contractify their shares.

Enter blockchains

In the U.S., rather uniquely, there is no public company register of who owns shares in a private company, in contrast with e.g. Singapore where shareholder data (including their residential address!) has to be filed with the country's Accounting and Corporate Regulatory Authority (ACRA), or the U.K. which has a (self-declared) ownership register publicly accessible on its Companies House website.

The same applies for most offshores, except that the responsibility for keeping a "Register of Members" is typically delegated to corporate service providers, without the need to publicly file ownership information (though more and more jurisdictions now require exchange of ownership information with a Government-owned ledger).

Not in the U.S.: here, companies can keep a ledger of their ownership in-house using any technology they deem fit.

As a result, many still keep spreadsheets or even an analog ledger book in which ownership details are recorded.

Given this choice of methods, blockchains are just another technology medium to record share ownership, and in the first wave of blockchain enthusiasm (late 2010s), permissioned blockchains (remember Hyperledger anyone, or R3 Corda?) were explored by legacy intermediaries as the canonical statutory stock ledger, using the same uncertificated route to digitize company stock and act as its Transfer Agent.

However, by going back to certificated shares, where the stock certificates are blockchain tokens, unpermissioned peer-to-peer blockchain technology networks (Ethereum comes first and foremost to mind) can take over this Transfer Agent Role.

In the U.S., it is lawful in certain U.S. states for blockchains to fulfill the role of a transfer agent, provided they conform to applicable federal and state regulations.

Federal level

At the federal level, the SEC has not explicitly barred blockchain technology from serving as TAs.

In our analysis the TA requirement only applies when intermediaries who use permissioned blockchains as the source of truth of ownership in a private company, i.a.w a Carta using a permissioned chain instead of a centralized database.

When a company instead choses to keep its shares certificated and use a public chain to track its ownership, the TA requirement would not apply.

State level

There is support for this analysis at the state level, where U.S. states have significant leeway in regulating corporate governance and securities within their jurisdiction, particularly under their business corporation laws.

Some states have explicitly embraced blockchain technology for roles like transfer agency:

- Delaware

Delaware, a hub for corporate law, amended its General Corporation Law (DGCL) in 2017 (Section 224) to allow companies to use “distributed electronic networks or databases” (i.e., blockchains) to maintain stock ledgers and perform transfer agent functions. This explicitly permits blockchain to replace traditional transfer agents for recording share ownership and transfers, as long as the system ensures accuracy and accessibility. - Wyoming

Wyoming has aggressively embraced blockchain through laws like the Wyoming Blockchain Bill (2019), which supports its use in corporate record-keeping. While not explicitly mentioning transfer agents, Wyoming’s Special Purpose Depository Institutions (SPDIs) and its recognition of digital assets align with blockchain fulfilling transfer agent roles, especially for tokenized securities. Overall, the state’s favorable stance suggests blockchain can legally serve this purpose. - Other States

States like Illinois, Arizona and Nevada have passed laws validating blockchain records and smart contracts, which indirectly support their use for transfer agent functions by ensuring legal enforceability of digital ownership records.

Other states (CA, NY) don’t prohibit the use of blockchains for transfer agent purposes but haven’t articulated rules, hence companies must rely on federal compliance and traditional corporate law, which may not fully accommodate blockchains without adaptation.

But everybody can see my wallet address...

Blockchains, by their nature, reliably track ownership, handle transfers and provide auditable records, the same way traditional TAs are expected to, however as public networks they do not shield the wallet addresses of who owns tokenized stock and may therefore allow for identification of those owners who would have chosen to remain publicly invisible on traditional ledgers.

This means some zero knowledge toggle may be required when blockchains take over the functions performed by legacy TAs, whose users can opt to keep their personal data private.

Certificated private company stock + zero knowledge public blockchains therefore seems to be the way to go.

What about securities regs?

Securities laws are essentially agnostic as to the technology layer used.

Securities, whether tokenized or not, must follow SEC rules (e.g., registration or exemptions like Regulation D or A), anti-fraud provisions, and investor protection standards.

"Reg D" is perhaps the most relevant exemption here, as most young private companies will likely raise capital by (pre-)selling tokenized ownership only to accredited investors.

Under Reg D, private companies issuing securities are exempted from a registration requirement with the SEC. They can raise from accredited investors (as defined) by simply filing a relatively straightforward Form D.

Reg D does not explicitly mandate that a private company must "know who buys its shares", in the sense of identifying every ultimate beneficial owner. However, it imposes specific requirements, mainly regarding accreditation verification, investor limits, and solicitation restrictions, that essentially compel companies to have a clear understanding of their investors' identities and qualifications.

So the short answer is that in theory you don't need to know who buys your shares but in practice you do.

However technologically it is not that difficult to implement this and have your investors buy your tokenized security without every having to sign a piece of paper:

- You can get them to whitelist their wallet using online KYC tools (centralized ones such as SumSub but preferably decentralized ones such as Fractal ID or Toggle) or by accessing lists of already white-listed wallets.

- As to investors' qualifications, to maintain the exemption and avoid SEC scrutiny (or lawsuits from investors), private companies typically document buyer identities and qualifications via the use of Subscription Agreements where investors self-certify their status, backed by records if needed. Here too, such "SAs"can be replaced by online self-certification tools in the form of a series of tick boxes, each a representation or warranty investors need to make before they can proceed, linked to a URL of the SA containing the necessary clauses that make it clear that cycling through the online steps and agreeing to each is equivalent to signing the agreement.

- Blockchains by their nature can monitor the number of investors and halt the offering when the cap is reached e.g. the maximum 35 non-accredited investors in a Reg D 506(b) offering.

- By going beyond mere tokenization and making your stock programmable using smart contracts, private stock transfer restrictions (e.g., under Rule 144, buyers must hold shares for 6-12 months) which require companies to know initial buyers and monitor subsequent transfers and are traditionally embedded in stock legends or analog agreements, can now be enforced via smart contract.

In the next chapter, we will look at such smart contracts in a bit more detail, as we believe programmable stock is what ultimately will bring companies onchain and lead to a step-change in RWA adoption.

II. DIY stack to tokenize your company today

Tokenization is technically quite trivial, and as such there is no need to partner with a platform such as Securitize or Tokensoft that does it for you.

You can use OpenZeppelin to do it yourself, using one of their audited, open-source smart contract templates.

The basic toolkit is free and consists of:

- Wallet: e.g. MetaMask (free).

- Development: Remix (free), Hardhat (free), VS Code (free), Cursor, etc.

- Blockchain Access: Alchemy or Infura API (free tier) for node access.

ERC-20 tokens

For instance, to tokenize the Membership of an LLC you have created offchain, you would:

- Start with the OpenZeppelin ERC-20 contract and add:

- Access Control: Restrict minting/burning to your LLC’s admin wallet (the wallet of the LLC's Manager).

- Transfer Restrictions: Code Rule 144 compliance (e.g., 6-month lockup) or whitelist approved investors.

- Pausable: Allow pausing transfers if legally required.

- Test the Contract:

- Use Remix to write and test locally.

- Deploy on a testnet (e.g., Ethereum's Sepolia) to debug.

- Deploy to Mainnet:

- Set up a wallet (e.g., MetaMask) with your LLC’s admin address.

- Fund it with ETH ($50-$100 for gas).

- Deploy via Remix or Hardhat, connecting to Ethereum mainnet.

Here is an example in simplified Solidity (use at your own risk!):

pragma solidity ^0.8.0;

import "@openzeppelin/contracts/token/ERC20/ERC20.sol";

import "@openzeppelin/contracts/access/Ownable.sol";

contract LLCMembershipToken is ERC20, Ownable {

mapping(address => bool) public whitelist;

constructor() ERC20("LLC Membership Token", "LLCM") {

_mint(msg.sender, 1000000 * 10**18); // 1M tokens, 18 decimals

}

function transfer(address to, uint256 amount) public override returns (bool) {

require(whitelist[to], "Recipient not whitelisted");

return super.transfer(to, amount);

}

function addToWhitelist(address _investor) external onlyOwner {

whitelist[_investor] = true;

}

}ERC-1400 token standard

Here is a further simplified code snippet using the ERC-1400 code standard (comprising a suite of a suite of standards including ERC-1410, ERC-1594, ERC-1643, and ERC-1644, designed specifically for security tokens) which is looking to achieve the following when tokenizing an LLC:

- Setup: Deploy an ERC-1400 contract on Ethereum.

- Structure: 1M tokens—700K for founders (locked 1 year), 300K for investors (tradable after KYC).

- Rules: Only whitelisted wallets can trade, per Reg D 506(c); 5% annual profit auto-distributed via smart contract.

- Docs: Link to your operating agreement on IPFS.

- Control: Retain the ability to freeze tokens if a member breaches terms.

contract LLCSecurityToken is ERC20 {

mapping(address => bool) public whitelist;

address public controller;

constructor() ERC20("LLC Token", "LLCT") {

controller = msg.sender;

_mint(msg.sender, 1000000 * 10**18); // 1M tokens

}

function transfer(address to, uint256 amount) public override returns (bool) {

require(whitelist[to], "Recipient not approved");

return super.transfer(to, amount);

}

function forceTransfer(address from, address to, uint256 amount) external {

require(msg.sender == controller, "Only controller");

_transfer(from, to, amount);

}

function addToWhitelist(address _investor) external {

require(msg.sender == controller, "Only controller");

whitelist[_investor] = true;

}

}OtoCo's built-in ERC-20 token foundry

Otonomos' sister company OtoCo instantly creates LLCs onchain in an entirely decentralized, self-custodied way, using your connected wallet, which means you shortcut on first having to create an LLC offchain with a registered agent and then putting it on blockchain.

Simple go to otoco.io and connect your wallet to spin up an LLC of which you will be first Member and Manager. Once created (which is immediate!), you then use that wallet to create an admin wallet for the entity and issue a token using OtoCo's built-in token foundry plug-in, which is a more evolved version of the above Open Zeppelin smart contract.

Legal mirroring

On the legal side, you would want to make sure that you are using an LLC operating agreement that:

- Authorizes tokenized membership interests.

- Assigns initial tokens to existing members (e.g., 1 token = 1% ownership).

- Defines token rights (e.g., profit distribution, voting, transferability).

- Include a “legend” restricting transfers per securities laws (e.g., Rule 144’s holding period), which as discussed above can be enforced onchain.

- Get member approval if required by your state (e.g., Delaware LLC Act §18-302).

OtoCo automatically replaces your Single Member Single Manager LLC Operating Agreement with a Multi-Member operating agreement that caters for tokenized Membership.

In addition, at the moment your LLC has multiple members, a governor smart contract kicks with governance rights coded into the token (using OpenZeppelin’s ERC20Votes extension) rather than handling governance offchain via member agreements.

What about C-Corps?

We blogged earlier about the potential for C-Corps to be put on blockchains and their key operating clauses codified as smart contract vs. legal prose.

Here too, as with listed stock, inertia, combined with the a desire for lawyers to keep legal prose deliberately vague, has stood in the way of tokenizing C-Corp stock.

In addition, the total addressable market for C-Corps is a subset of LLCs, and is broadly limited to U.S.-based teams who raise from (U.S-based) VC.

Also, a serial founder will probably only set up 3 - 5 times in his/her lifetime - how many startups do you have in you?

LLCs by contrast not only work for non-U.S. owners but offer extreme flexibility in use cases, from single member/owner entities to investment clubs to U.S. feeders into offshore investment funds.

To our knowledge, perhaps for the above reasons, nobody has so far credibly coded up the C-Corp as a bundle of smart contracts. Firm.org, founded by ex-Aragon lead Luis Cuende, came closest but gave up after it got stuck in a legal and regulatory quagmire. Its vision however remains intact and legaltech innovators such as Fairmint are taken over Firm's baton.

What are the benefits of tokenizing my company's shares?

1. Increased Liquidity

- Tokenization enables trading on secondary markets, both centralized (e.g. Forge and decentralized ones, making illiquid private company shares more accessible. As we have seen, provided your shares are certificated, blockchains can fulfil the role of transfer agent and your stock can trade peer-to-peer, subject to applicable regulations. As a result, a decentralized private company platform is feasible in which all "listing rules" are enforced by smart contract.

- Fractionalization: Tokens can represent tiny fractions of a share (e.g., 0.001% of an LLC), allowing investors to buy and sell small stakes, again subject to securities laws (e.g., Rule 144 holding periods). As we have seen, transfer restrictions can be programmed into your shares using fairly rudimentary smart contracts (see above).

- Employees, early investors, or founders can cash out without waiting for an IPO or acquisition—e.g., a startup employee might sell $10,000 worth of tokens instead of holding illiquid stock options worth millions on paper.

- Private market liquidity is growing, with platforms facilitating $10B+ in annual trades, per recent estimates.

2. Cost Efficiency

- Tokenizing private company ownership - converting traditional equity or membership interests into digital tokens on a blockchain - reduces administrative and intermediary costs associated with traditional equity management and captable in the cloud solutions such as Carta.

- Blockchains eliminates paper certificates, manual cap table updates, and legal paperwork. Smart contracts automate tasks like dividend payouts or voting.

- Platforms such as Carta start with annual subscriptions of US$1,800 which can easily go up to US$10k/year, while smart contract deployment on Ethereum would cost an est. US$50 in gas fees and transfers cost pennies.

3. Streamlined Administration

- Benefit: Simplifies ownership tracking, transfers, and governance through a transparent, immutable ledger.

- Tokens are managed via smart contracts, automatically updating ownership records on-chain. No need for transfer agents or endless spreadsheets.

- A founder can issue new tokens, transfer ownership, or adjust rights in minutes. E.g. an LLC could mint tokens for new members and enforce transfer restrictions (e.g., right of first refusal) via code, not lawyers. OtoCo already does that when users use its Multi-Member LLC plugin.

4. Enhanced Transparency

- Blockchains, by their nature, provides a clear, auditable record of ownership, reducing disputes and fraud.

- Blockchains' immutability logs every token issuance, transfer, or burn, visible to authorized parties (e.g., via private channels in Hyperledger or whitelists on Ethereum).

- As a result, blockchains can act as the single source of truth of a company's cap table—e.g., no risk of double-counted shares or hidden dilution. Regulators can audit compliance easily.

5. Programmable Ownership Rights

- Governance rights and financial rules can be directly embedded into tokens, automating complex processes.

- Smart contracts can code voting rights, profit distributions, or lockup periods (e.g., 6-month Rule 144 hold). A token holder might automatically receive ETH dividends proportional to their stake.

- Saves legal and operational overhead—e.g., an LLC could distribute 10% of profits quarterly without manual calculations or bank wires, or a tokenized startup could enforce founder vesting schedules on-chain, releasing tokens over 4 years.

6. Global Reach

- A tokenized pool of ownership shares expands the investor pool beyond local or national boundaries, tapping into international capital.

- Tokens can be marketed and sold globally (subject to compliance, e.g., Reg S for non-U.S. investors), accessible via crypto wallets anywhere.

- A U.S. LLC could raise funds from Asia or Europe—e.g., a Singapore investor buys tokens without complex cross-border paperwork.

- Cross-border VC deals are rising; tokenization accelerates this trend by simplifying logistics.

7. Speed

- Enables near-instant settlement and transfers compared to traditional equity processes.

- Blockchain transactions settle in seconds or minutes, versus days or weeks for paper-based transfers.

- Speeds up fundraising or exits—e.g., an angel investor buys tokens in a day instead of waiting for notarized docs and bank clearance.

- Public markets moved to T+1 in 2024; private tokenization is already T+0.

8. Potential for Automation and Integration

- Benefit: Integrates with DeFi and Web3 ecosystems, unlocking new financial tools.

- Tokens can collateralize loans, join liquidity pools, or integrate with decentralized governance platforms (e.g., DAO-like structures).

- A company might use tokenized equity as loan collateral on Aave, or let members vote via Snapshot—all automated on-chain.

- AI agents can operate on smart contracts, but cannot take offchain actions incl. execution legal agreements. This opens the prospects for companies to be managed with the help of autonomous AI agents.

Conclusion: Private company shares won't list anymore but scale along a continuum of liquidity

With ever more companies delaying a listing or never going public at all, RWA should find its first genuine DeFi application in using blockchains to track and trade private company shares.

Once tokenized, private company shares will essentially be public from day one, removing the raison d'être for centralized stock exchanges plus various other intermediaries such as The Depositary Trust Company, Cede & Co, brokerages, Broadridge, etc.

Instead, private company shares will trade peer-to-peer on decentralized, CowSwap-type DEXs.

Tokenizing LLCs, with their panoply of use cases for both U.S. and non-U.S. owners, is the bottom-up scenario that will lead to decentralized platforms such as OtoCo to help owners tokenize their entities, complemented by fully fledged decentralized exchanges for security tokens which smart-contract enforced regulatory compliance.

> Explore today how to tokenize your company's shares