Ras Al-Khaimah, often abbreviated as RAK, is the northernmost Emirate of the United Arab Emirates (UAE) and serves as its largest city and capital.

It is situated on the Musandam Peninsula, bordering beautiful Oman, and ranks very high on global ease-of-doing-business indices as a result of its Ras Al Khaimah Free Trade Zone (RAK FTZ) free zone regime.

As with neighboring free zones, RAK FTZ, established in May 2000, offers a business-friendly environment with various incentives aimed at attracting foreign investment and fostering economic growth.

RAK FTZ offers:

- Tax Benefits: RAK FTZ provides a tax-free environment, allowing companies to operate without corporate taxes or income taxes, making it one of the most cost-effective free zones in the region.

- 100% Foreign Ownership: Investors can fully own their businesses without the need for a local partner, which is a significant advantage for foreign entrepreneurs.

- Business Support Services: The zone offers fast-track visa processing, assistance with labor sourcing, and ongoing support services to facilitate business operations.

- Diverse Business Parks: RAK FTZ comprises several specialized parks:

From RAK FTZ to RAK DAO

Officially launched on October 19, 2023, RAK DAO (or Ras Al Khaimah Digital Assets Oasis, not the RAK Decentralized Autonomous Organization!) is a pioneering free zone specifically designed to support businesses in the digital assets sector.

It is arguably the world's first free zone with Common Law features specifically tailored to blockchain, cryptocurrency, and Web3 enterprises.

RAK DAO offers:

- Common Law Framework: It operates under a legal system that provides transparency and security for businesses involved in digital assets, reducing risks and enhancing international-standard legal protections for companies.

- Focus on Digital Assets: The free zone caters exclusively to companies engaged in blockchain technology, cryptocurrencies, decentralized finance (DeFi), NFTs, and other digital asset innovations. This specialized focus aims to position RAK DAO as a hub for next-generation technologists and entrepreneurs.

- Regulatory Support: RAK DAO offers comprehensive regulatory assistance to help businesses navigate the complexities of operating within the digital asset landscape. This includes guidance on compliance, licensing, and reporting requirements.

- Tax Advantages: Companies operating in RAK DAO benefit from a zero-tax environment, which includes no corporate taxes or personal income taxes. This favorable tax regime allows businesses to reinvest profits into their operations more effectively or distribute profits in a tax-optimized way.

RAK DAO as a base for your Web3 business

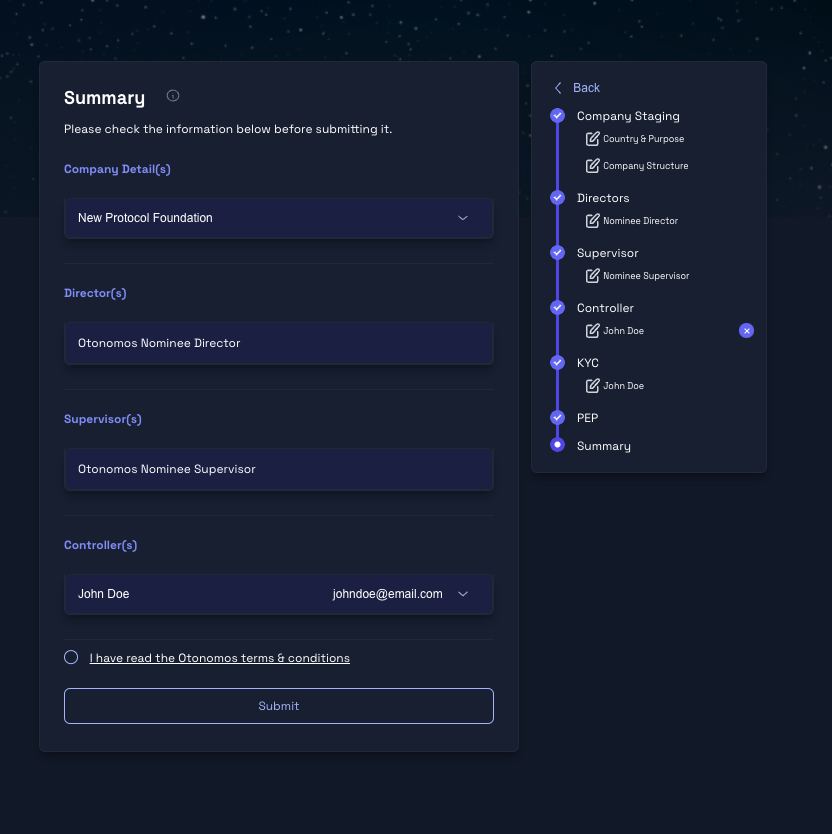

Setting up a business within RAK DAO is designed to be straightforward but does come with a degree of formalities, all of which Otonomos can help with.

- Choose a Company Name: Ensure that your business name complies with the Free Zone’s naming regulations and is unique within the UAE.

- Submit the Application: The application process for RAK DAO involves submitting your business plan, personal identification documents, and other necessary paperwork to the Free Zone authorities. RAK DAO offers multiple business structures to suit different types of operations:

- Free Zone Establishment (FZE): A single shareholder entity.

- Free Zone Company (FZC): Allows for multiple shareholders.

- Branch Office: For established companies looking to expand with a presence in the region.

- Obtain Your License: Entrepreneurs must identify their specific business activity from a range of options related to digital assets. Each business type will require specific licenses and regulatory approvals:

- Blockchain technology companies

- Crypto exchanges

- NFT platforms

- Web3 and decentralized finance (DeFi) projects

- Crypto asset trading companies

- Decentralized applications (DApps)

Once the application is approved, you will receive a license to operate your digital assets company within RAK DAO.

From Digital Asset Oasis to Decentralized Autonomous Organization wrapper

In late October of this year, RAK DAO took a further step to put itself on the Web3 map by announcing a legal framework for DAOs, with the aim to create "tax optimization and legal clarity" for users.

The DAO Association Regime (DARe) provides a structured legal identity for DAOs operating within the RAK free trade zone, facilitating their interaction with traditional financial systems while preserving their decentralized nature.

Key features include:

- Legal Recognition: DARe allows DAOs to incorporate as legally recognized entities in the UAE, granting them a distinct legal personality. This status enables DAOs to own assets, enter contracts, and engage in business activities legally and transparently.

- Operational Flexibility: The framework supports both on-chain and off-chain operations, providing a structure for DAOs to function effectively within legal systems. This flexibility is helpful for DAOs looking to bridge the gap between decentralized governance and traditional business practices.

- Tax Optimization: DARe offers various tax incentives, including reduced corporate taxes and exemptions on specific types of income.

However, a RAK DAO Association operates as a nonprofit entity. This designation means that while the Association can engage in activities that generate revenue to fund its operations, it cannot distribute profits to its members or stakeholders. Instead, all income must be reinvested into achieving the association's stated mission or supporting its operations.

Members can, however, receive reasonable compensation for their contributions, such as salaries, contractor payments, or reimbursement for expenses incurred while providing services to the DAO.

This structure is meant to ensure that the association remains mission-focused, prioritizing community benefit and long-term sustainability over financial gain for individual members. - Governance Structure: A DAO Association under DARe must have at least two founding members who provide guarantees regarding the association's activities. The governance is managed by a council formed by the DAO members, ensuring that operational decisions align with the community's interests. DAO token holders are Members, which means they benefit from limited liability.

- Enhanced Liability Protection: The framework provides increased liability protection for DAO founders, members, and contributors, further legitimizing their operations within the legal landscape of the UAE.

Mini or Maxi DAO

There are currently two DAO Association wrappers available: a "startup DAO" which cannot have more than US$1MM in assets and is limited to 100 Members, and an "alpha" DAO which can have more than US$1MM in assets and more than 100 Members.

Both will need a lease contract with a physical space in RAK to be validly established (the UAE remains a real estate play!) and can be augmented with residency visas for designated Members, which is a very attractive options as it allows Members to live and work in the whole of the UAE.

As easy as it seems?

A quote ascribed to Benjamin Brewster comes to mind:

In theory there is no difference between theory and practice, while in practice there is.

In theory, the RAK DAO is clearly based on the association model, which in certain jurisdictions such as the U.S. and Switzerland merely requires two members to agree on a common purpose, without the need for any form of registration and gives quasi-complete freedom to organize governance as they see fit, as long as they respect the non-profit logic of an association.

A number of jurisdictions have jumped on the stage claiming to innovate by engineering "DAO wrappers" which are in essence assocations in theory, but introduce more formalism in practice.

In the case of the RAK DAO, establishing a DAO in the free zone does require careful planning and following specific guidelines.

- First, as DAO founders you will need to evaluate your DAO's eligibility to ensure it aligns with the DARe framework. This includes having a clearly defined purpose, a robust governance model, and compliance with UAE regulatory standards.

- Additionally, your DAO must be able to provide essential documentation such as a detailed white paper and project documentation.

- Further, you will need to prepare and submit the required documentation. This includes a business plan that highlights your DAO's goals and strategies, a governance framework that details how decisions are made and executed, and a legal opinion confirming compliance with the applicable laws and regulations. Where relevant, a tokenomics document should also be included, explaining the structure and economic model of the DAO's token.

- Once the documentation is ready, you can proceed with the registration process. This process includes registering the association's name, appointing a registered agent in Ras Al Khaimah, and paying the applicable registration and licensing fees.

- During the formation of a DAO Association, the founding members, council members, and any persons appointed in the office, such as managers who oversee daily operations, will be required to undergo and complete the identification and KYC procedures. The DAO Association must have a local registered agent or founding partner resident in the UAE.

- Finally, what are considered "Virtual Asset Services", such as managing digital assets of others, exchanging digital assets, or providing blockchain-based financial services, are regulated UAE-wide. Accordingly, engaging in such activities would require obtaining a Virtual Asset Service Provider (VASP) license and complying with other regulatory requirements under a seperate authorization from UAE authorities. However, even when DAO Associations engage in virtual asset activities which do not require special authorization under federal securities or financial service regulations under the VASP laws, such as operating blockchain nodes, providing non-custodial wallets or protocols, and other blockchain-related activities, RAK DAO has its own gamut of licenses.

- Very finally, DAOs in RAK DAO issuing tokens must meet specific requirements, including a legal review of the token's regulatory status and a security audit.

CONCLUSION

In summary, establishing a DAO in RAK DAO (hence a "RAK DAO DAO") is a highly permissioned process, perhaps in line with the predominant government regime in the UAE which in many way is highly suspicious and controlling of its citizens and by extension its residents.

It is therefore for each of DAO founder to weigh the pros (tax, residency option) and contras (formalism, expense) of using a DAO wrapper in RAK DAO.

If they do decide in favor, Otonomos can help with the entire process and including supporting documents and filing.

>> Schedule a call today with Otonomos to talk about your options and get the ins and outs on available DAO wrappers.