Company formation and corporate services: the last analog bastion of the business world

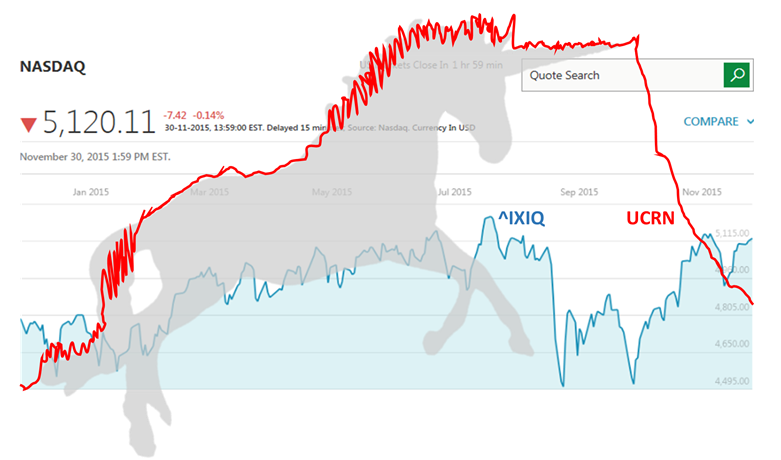

In this post, we examine the quirks of the US$100BN a year corporate services market and how the interplay between blockchains and AI have the potential to drag it into the digital world.