The October Otonomist looks back on Ethereum’s DevCon VI in Bogotá and posts about clear and present regulatory dangers. We also offer a preview of what’s brewing at OtoCo and a short FAQ on the OTOCO token economics. Oh, and you’re invited to our next online seminar about the optimal entity stack for crypto entrepreneurs.

Have a productive November!

Han

OTOCO DEVELOPMENT UPDATE

We Are Working on a New User Experience for OtoCo

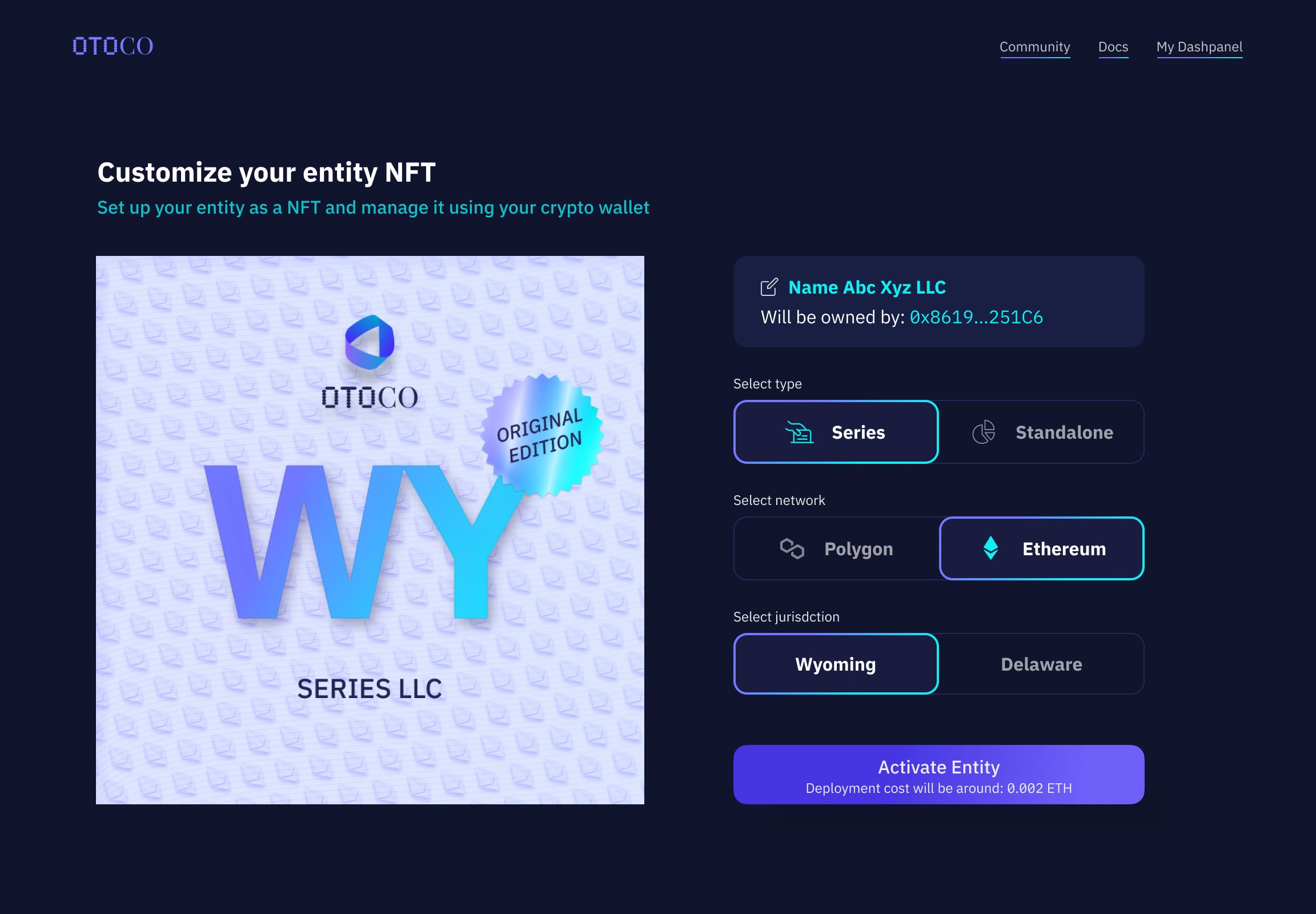

In early October, we kicked of a new design sprint for the OtoCo front-end that aims to change the way users build and interact with their entities.

The new approach uses the entity’s NFT as the core to which users can tentatively load on characteristics and boosts, similar to game avatars.

This ties in with our longer-term vision of business building as a massive multi-player online role-playing game in which each “player” brings an avatar (wallet) with actual legal privileges in the organization in which (s)he participates.

The above is a preview of the first of a number of iterations that aims to put ease and delight of use at the heart of how we eventually see company formation move into the metaverse.

> Receive updates on our progress and participate in OtoCo as a community project by joining our official Telegram group or buy the OTOCO token on Uniswap V3.1

FOUNDER’S NOTES

DevCon VI: An All-You-Can-Eat Buffet of Ideas

DevCon VI, the first DevCon in 3 years after Covid stood between Prague and Bogotá, marked the community’s first post-Merge get together.

With 11 tracks to choose from over 4 days between 11 and 14 October, ranging from sessions on Governance & Coordination to Zero-Knowledge Protocols, DevCon VI felt like an all-you-can eat buffet of intellectual stimulus.

Read the full post for our 8 observations from a whirlwind conference week.

UNBOUNDED THINKING

Sleepwalking into Mass Surveillance: Clear and Present Regulatory Dangers for Crypto

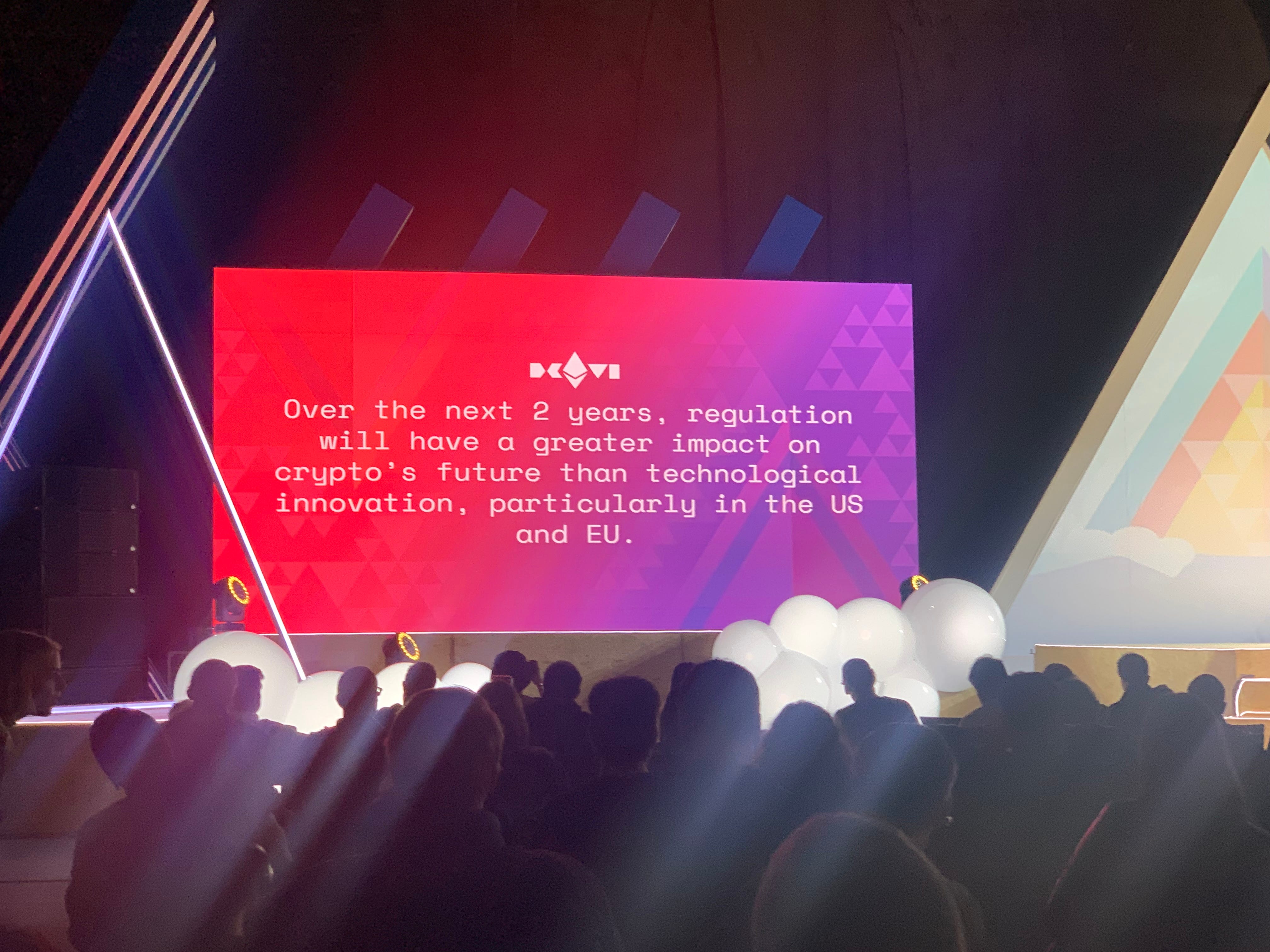

Crypto regulations and privacy received a lot of attention at this years’s Ethereum DevCon VI conference.

There is a general David vs. Goliath feel, with some suspecting regulatory capture by TradFin and big corps, and others lamenting that new rules are being drafted by occasionally well-meaning but universally crypto-ignorant rulemakers.

The general consensus is that little good can come out of new rules as they currently stand. The community can now either shrug (typically the Europeans who make a habit of ignoring rules as they have too many of them) or organize itself (typically the Americans who hope for better rules and look for ways to influence them).

In this post, we share 3 immediate threats identified with the help of the legal minds at analybits.xyz and close with a call to action.

OVER AT OTOCO.IO

OTOCO Tokenomics: FAQs and Future Funding

Back in March, OtoCo minted an initial 8 million OTOCO tokens of which just over 2MM were reserved by users and the wider community using a smart contract launchpool with algorithmic price-setting: the earlier one reserved OTOCO tokens, the lower the price.

A total US$ 1,100,143 was raised at an average price of US$ 0.54 per OTOCO token.

Recently, following a community vote, a first (small) OTOCO/USDC liquidity pool was created and the OtoCo Foundation was given the green light to raise up to US$ 4MM from a private token sale out of its community chest.

This post focuses on when and how further tokens will be minted and how they will be allocated.

> DM @OtoCoDAO on Telegram to learn how to participate in our private sale.

ANNOUNCEMENT

Join our FREE hour-long Q&A on the optimal Web3 entity stack

You’re invited to an hour-long Q&A about the optimal entity stack for Web3 doers and investors.

Based on over a thousand data points from existing Otonomos clients, we will be covering topics including:

- Offshore vs. onshore?

- How to get to an optimal decentralized stack?

- What setup are crypto investors most comfortable with?

> Join us on Thursday 17 November at 8 am PST // 11 am New York // 4pm London // 5 pm CET!

NEXT MONTH: Next month’s Otonomist will give an update on progress on the OtoCo development sprint, and give an update on recent trends in crypto hedge fund setups. Our thought piece will focus on alternatives to the economic growth model. As always (except this month…) in your inbox on the last Thursday of the month.

Just select USDC as the first asset and paste the OTOCO token smart contract address in the second asset field in Uniswap to swap USDC for OTOCO tokens. ↩