Capital formation is the Holy Grail of decentralized finance: how to preserve the ease of DeFi-style staking with the process of raising capital for a project, a company or a fund?

On the one hand, DeFi-style pooling is fast, cheap (even with high gas fees…) and global: users simply send their crypto to a pool and get a share of the pool. A pool for an Automated Market Maker or a lending protocol can collect tens of millions of dollars in a week.

On the other hand, capital formation for companies uses a more complex investment contract for shares, notes or units. The offer includes a lot of details that take time to figure out and money to document. It is subject to securities regulations about how it can be sold, and who it can be sold to.

We’ve been doing this all wrong

Launch pools are what you get when you cross DeFi-style pooling with escrow on blockchain to simplify capital formation.

It essentially reshuffles the sequence of how you raise money for your project, by first engaging investors with a refundable escrow pool and only turning it into committed capital once the project passes a community vote.

You have time to do what’s necessary to make the deal work, depending on the needs of your project: you choose a legal form, accredit investors, or in some circumstances you can swap the pool tokens into a utility token and go fully decentralized.

In designing the launch pool, we took inspiration from the SPAC (Special Purpose Acquisition Company) which has recently received a lot of attention in the legacy financial world.

SPACs ask investors to invest in an IPO of an acquisition target before the target is known.

Why would you ever do that? The answer is that SPACs limit risk at each stage:

- Before the target is identified, you can resell SPAC shares, or redeem them if you do not want to participate in a proposed acquisition.

- If you redeem, you get your money back, plus a market rate of interest

- Plus you get something extra for buying the initial offering, in the form of warrants that will be valuable if the deal is successful..

- Finally, SPAC investors get to vote on potential acquisitions.

A new approach

For our design of a launch pool, we took some of the above features of a SPAC, but we used DeFi to keep assets (and their returns) in the hands of the investor, whilst pushing out the legal setup.

The lifecycle would look as follows:

- You work on a project but need funding. You of course think it’s a compelling investment but some questions remain and you’d like to see it validated.

- You create a launch pool, and you announce it with a link in all of your media. This is not an offer of investment, since you are not asking them to send you money. You are asking them to show some interest in return for a voice in your process.

- Contributors can stake assets that they want to hold anyway (coins or interest-earning assets). By staking, they get votes. They also get a place in line. The earlier investors will receive a bonus, something extra beyond their current return.

- Answers to the questions around the project get thrashed out as you go along via the same channels, probably using some of the community feedback you got.

- This results in an investment proposal with a specific investment vehicle and a purchase process.

- You then call a vote by asking stakers to commit to the new investment.

- If the proposal reaches a threshold commitment you have set, you convert the stakes that voted “Yes” to the new investment. At this stage,, investor qualification may be required to ensure regulatory compliance.

Variations to the above could include a set-and-forget option that automatically commits stakers who do not want to follow the whole discussion.

Intended benefits include:

- Savings: Users can engage with investors and test demand before they spend money on a legal structure (from Otonomos). This could be particularly relevant for funds, which can absorb costs of between USD 50,000 - 200,000 for setup, admin, regulatory and insurance. It may also delay the setup costs related to the cascade of entities required to conduct and decentralize a token sale.

- Customization: The investor community can request an investment structure that works for the majority.

- Collaboration: The community has a much higher degree of participation compared to legacy investments, and avoids torturous KYC before they are even sure about the deal.

- Feedback: For you and your core team, it shortens the distance between an idea and its validation, which is worth a lot: if you are going to get a no, better get a no soon so you can iterate, pivot or move on.

The end of the fund as we know it

Launch pools do not have to be limited to startups and new ideas.

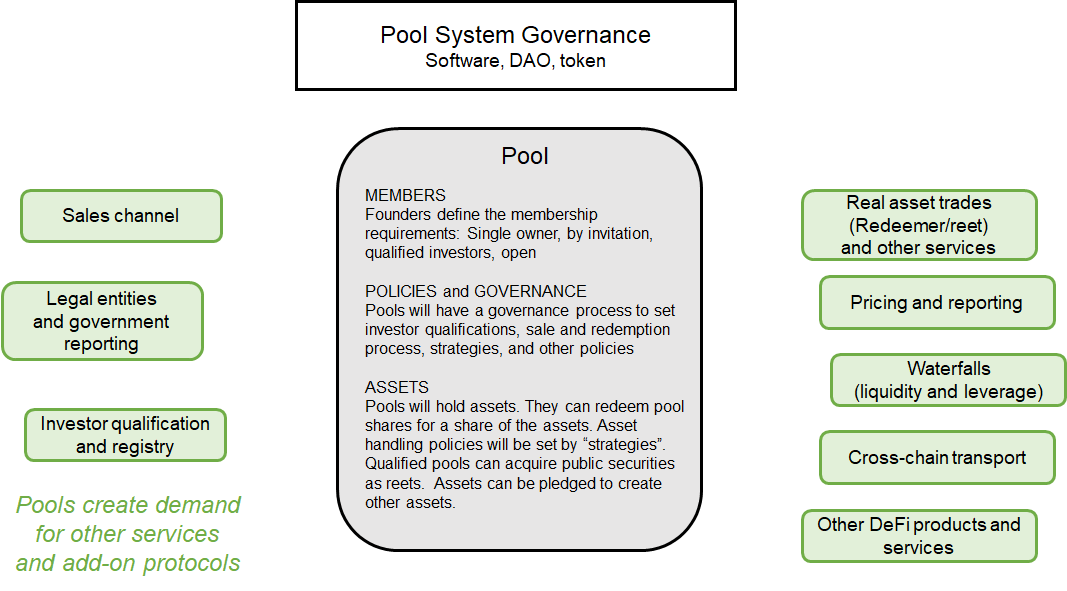

We see a very powerful application for organizing investment funds. Funds can “Launch” and “Organize” in collaboration with investors.

- LAUNCH: In the Launch phase, a fund sponsor would simply create a pool and set initial policies. Typically, some founding members (“cornerstone stakers”) would be invited in.

- ORGANIZE: Optionally, you can adjust your pool’s policies via an onchain member vote, add investor qualifications at this stage, add a legal entity, etc. All these are spare parts along the assembly line which sponsors can add as they see fit. At a very minimum, what would need definition is the threshold for conversion of the refundable contributions into committed capital. In the case of a fund setup, at this stage asset restrictions and investment strategies would be approved. On-chain rules will reduce off chain admin and audit costs.

- INVEST: Once capital is committed, assets could be acquired into the committed pool. This could be done automatically via algorithms and/or with human skills and investments may be made subject to an investor vote. Waterfalls could be customized to create leverage and distribute risk and fees..

- FUND: The fund could be opened to further investors at this stage by issuing additional shares. Shares would be tokenized and programmed with specific compliance features such as non-transferability, geographic restrictions etc.

- REDEEM: Funds holding liquid assets will allow investors to conveniently buy and redeem.

The setup described above has the potential to move investment activity away from expensive fund management to onchain scripts.

To setup a launch pool to raise capital for a fund, you would need:

- Information about the founder and manager of the pool;

- Information about the proposed investment;

- Channels for communicating about the deal (website, chat, forums, repositories).

- What is the decision that the pool is trying to make before committing?

- What is the “something extra” that initial stakers will get by making early contributions?

Use cases galore

Other use cases too come to mind:

- SPAC-style acquisitions. Gather funds before you know what company you want to invest in. The community can decide if they like your target.

- Gather funds for a DeFi startup before you know if you’re selling non-US tokens, or equity. The community can decide and you can try to deliver it.

- A waitlist to reduce stress in a high-demand token offering.

- Gather funds for a startup before you have attracted key team members. The community of investors can help with recruiting, and the money that they commit will make the job more attractive for team members and partners. Close the deal after the project attracts the right team members and partners.

Product design

So far our design is still on the drawing board with an initial spec for the launch pool smart contract, but we have yet to build a product around it.

Some of the decisions we’ll need to make towards a first launch pool are:

- What crypto assets can contributors stake in a launch pool? In principle there is no restriction and even e.g. interest-earning digital assets should be stakeable to reduce the cost of depositing into the launch pool. Initially however, it may be easier to limit a first launch pool to stablecoins.

- What is the something extra? The “something extra” would be calculated on the basis of the order in which stakes arrive, with early stakers getting a bigger bonus if they stay through closing.

Extensions

Eventually, launch pools could be offered on otoco.io as the first component along an onchain investment deal “assembly line”.

Such assembly line will in most cases require a legal wrapper in the form of an onchain LLC or some other legal entity, components OtoCo and otonomos.com already offer.

Other components users may need are services that qualify investors and track investor qualifications associated with blockchain addresses. Some pools will need to use this information to create real-name registries of their investors.

Below is an overview of the add-on services and protocols for pools:

I want you to exist

Elon Musk once said that the secret of building successful companies is to make sure people really REALLY want your product to exist.

With launch pools, if the community really really wants some project to happen, we should give them the tools to stake projects, reward early stakers, and get into a committed deal as frictionless as possible.

OtoCo will soon be running its own launch pool to test if the community really really wants OtoCo to happen the way we have it planned: as an onchain assembler of pools and organizations for the crypto and blockchain economy. Think WordPress for decentralized projects, only better, smart contractified and with a dApp plugin store.

To help us design our launch pool, we’ve put together a short poll which also lets you pre-register.

If you’r reading this on mobile, you can also just scan the QR code below to pre-register:

Based on the poll’s results, we’ll craft a specific proposal for OtoCo and broadcast it to the community together with our launch pool smart contract address.

As a contributor, you will be able to put refundable stakes into the pool and vote on our investment thesis. The earlier you stake, the bigger your reward if you eventually commit.

Join our official Telegram group to receive updates.