In the last part of our Fundraise Special, we look at a possible third and arguably hardest way: growing your business out of its own revenue.

We ask what business models lend themselves best to grow out of their own revenue and what solutions are out there to help you bridge working capital shortfalls.

We conclude with a predication that ever more businesses, thanks to the power-law boost in productivity from AI and the free availability of blockchains as a public good, will self-finance and grow to 100MM ARR with teams of less than 10 people.

Hustle vs.gamble

There's a saying that a business without funding is a hustle, while a business with third party capital is a gamble.

Relying on your own internal resources to fund operations, growth, and development rather than seeking external capital from investors has distinct advantages and challenges.

Self-financed businesses typically start with the founder’s personal savings. Our rule is that you have to have 18 months of savings to carry you through your personal cash burn before you can expect that your business will carry you.

This means that cash burn will be the key variable in the early days: if you feel you need to live in say the Bay Area or made a lifestyle choice to live in any other brutally expensive place, your cash burn will obviously be a lot higher so you will need higher savings to keep to an 18 month runway.

Revenue from early sales will help, but will typically only cover expenses in the business, if at all. So do contributions from friends and family. Best is if you can structure these as a loan rather than an equity stake. They'll be patient creditors!

Alternatively, if your project issues token, you can have them contribute under a SAFT.

Real growth vs. false metrics

When you self-finance, there is no hiding. False metrics, often used in VC-funded deals, means cheating on yourself. The key is to:

- Scale slowly by using cash flow from customers.

- Keep costs low, often by focusing on a niche market, minimizing overhead, or leveraging existing skills and resources.

- Have your customers fund you: Use pre-orders, subscriptions, or deposits to generate cash upfront (e.g., how Dell started by building computers after receiving orders).

The advantages are clear:

- Full control: Founders retain 100% ownership and decision-making power, avoiding dilution of equity or interference from investors.

- Focus on profitability: Without pressure to chase rapid growth for investors, these businesses prioritize sustainable revenue and profitability early on.

- Flexibility: They can pivot or experiment without needing approval from a board or shareholders.

- Resilience: Less reliance on debt or external funding can make them more adaptable during economic downturns.

Examples of successful bootstrapped Web2 companies include Mailchimp (sold for $12 billion in 2021 without ever raising venture capital) and Basecamp, which grew steadily over decades with a small team and consistent profits.

More traditional examples would be Amancio Ortega's Inditex, owner of Zara, showing how retail is the ultimate self-financing business model, leading to some of the world's biggest fortunes (est. US$ 134.3 BN as of September 2024).

Basecamp's Jason Fried became a vocal advocate for self-financed businesses, challenging established thinking on fundraising and growth, and fulminating against VC in the process.

Trade-offs

Self-funding comes with obvious trade-offs. Essentially, you'll feel very lonely and be eating glass rather than appearing on Bloomberg yapping about how to best burn other people's money.

- Slower Growth: Without a big cash infusion, scaling can take longer, potentially allowing VC-backed competitors to capture market share faster.

- Resource Constraints: Limited funds might restrict hiring, marketing, or R&D, forcing tough trade-offs.

- Personal Risk: Founders often bear significant financial burden, dipping into savings or forgoing salaries. They may have to sign personal guarantees despite the adage that a personal guarantor is a fool with a pen in his/her hand).

- Cash Flow Pressure: A bad quarter or unexpected expense can hit harder when there’s no external cushion.

- Lonely and under-appreciated: There will be a toll on family life, your friends will misunderstand you, and your family will wonder why you got that degree. Skip that MBA, start as young as you can, don't take a mortgage and make sure you got full buy-in from your partner.

Self-financing busines models

Here are some more examples of business, per category, that self-financed entirely or took outside money at a very late stage:

- Technology businesses: Companies like GitHub (pre-Microsoft acquisition) and Atlassian bootstrapped for years before taking any outside money, proving software’s low startup costs make it a prime sector for self-financing.

- Service-Based Businesses: Freelancers, consultants, or agencies often self-finance because they can start small and scale with client revenue. However, pure service businesses don't scale well as they rely on people's time, and time doesn't scale. No matter how hard you work, there are only 24 hours in the day!

- Product Businesses: Niche physical goods companies, like Spanx (Sara Blakely famously started with $5,000 of her own money), use early sales to fund inventory and expansion.

Crypto: No more infra costs

In our analysis, what applies to software businesses applies doubly to crypto.

Given that blockchains are a public good, and other infrastructure is typically open source too, the development cost of building dApps is lower than any other business. AI will further compress development costs, as software is now written for you and front-ends built right in front of your eyes.

Distribution too is largely via the community without the need for expensive PR or paid-for advertising.

The most significant cost for anybody building in Web3 is attention. Few projects stick with building for the long-term as the temptation is always there to jump on the next thing.

In this respect, we blogged a while back about the DAO equivalent of an Employee Stock Option Plan as a way to create a loyal pool of employees and wider contributors for your Web3 project.

Communality between self-funded businesses

Looking closer at self-funded businesses, they seem to have the following in common:

- Nail a Profitable Niche: Focus on a specific problem or audience where competition is low and margins are high.

- Iterate Quickly: Use customer feedback to refine offerings without over-investing in untested ideas.

- Build Recurring Revenue: Subscriptions or repeat customers provide predictable cash flow (think SaaS models or consumables). Crypto broadened possible recurring revenue streams.

- Stay Frugal: Avoid unnecessary expenses—many bootstrappers work remotely, outsource non-core tasks, or use open-source tools.

Conclusion

Compared to VC-backed firms, self-financing businesses might not become "unicorns" overnight, but they often outlast flash-in-the-pan startups that burn through cash.

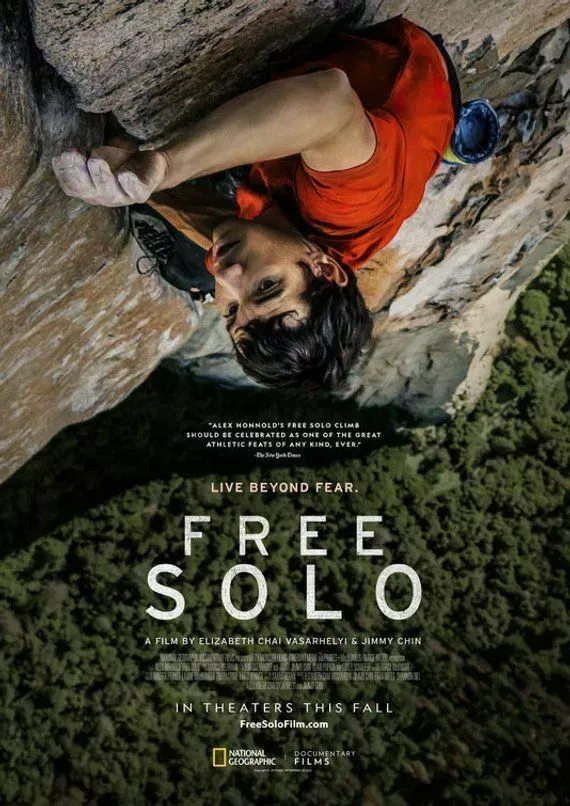

In our analysis, businesses succeed when Founders stay at it with grit and determination, and self-financed business are the ultimate rope-free climb.

A 2023 study from the Kauffman Foundation noted that 80% of Inc. 5000 companies (fastest-growing private firms in the U.S.) were "bootstrapped", suggesting self-financing doesn’t preclude significant success—it just takes a different - and for many Founders a much more fulfilling and rewarding - path.

> We're always happy to hear about your project and share what we see in the market! Schedule a call today for a 30-mins chat.

Further reading

Over the years, Otonomos has been blogging regularly about capital formation and token issuance. Here is a selection organized by hashtag. Note: some posts will require a subscription.

- #Capital formation

- #Tokens and tokenization

- OtoCo's experiment in raising from its early users and followers using bonding curves: https://newsletter.otonomos.com/p/part-iii-a-new-smart-contract-solution