Arbitrage between jurisdictions

The United Arab Emirates has been a net benefactor of a worldwide shift of talent and money post-COVID, against a backdrop of geopolitical and regulatory shifts.

Otonomos’ mission is to help entrepreneurs work from anywhere by making it easier to form and maintain their entity stack in jurisdictions that work for them and where they prefer to work from.

To respond to the demand for a UAE base, we have now put a robust and good-value incorporation package together that lets you form an entity in one of the most attractive Dubai free zones for crypto and blockchain entrepreneurs, the Dubai Multi Commodity Centre (DMCC).

We’ve streamlined the process to get you all set up within a week without any headaches, and offer ancillary work visa, office and bank account services for those clients who also want to physically move to Dubai, in addition to basing their company there.

In what follows we highlight the benefits of a UAE company. We then walk readers through the process and fees. We close with an overview of our service offering in the UAE.

A. Why Dubai?

First, Dubai is one of the seven Emirates (together with Abu Dhabi, the UAE’s capital, Ajman, Fujairah, Ras Al Khaimah, Sharjah, and Umm Al Quwain) that form the United Arab Emirates.

The ones that attract most expats are Dubai and Abu Dhabi, but the former attracts the bulk of company formations.

As a result, Dubai has a population that on recent estimates consists of 80% expatriates. Apart from the ”business class” lifestyle, arguably the main reason they flock to Dubai is that it has 0% income tax: not only is there no tax on foreign income but also domestic income such as salaries paid from a Dubai entity to resident employees is tax-exempt.

So if you live there for a couple of years, as lots of expats do, you can build yourself a nice nest egg, again as lots of expats do…

Until June 2023, when the UAE will introduce a 9% corporate tax, companies aren’t taxed either.

This means it is also attractive for business owners to establish a company there, even without moving to the UAE.

If you do have a local company, you can become resident there, which is something only a handful of jurisdictions offer.

However, such company+residency combo is only available if you form your company in one of the 45 economic free zones in the UAE: special economic zones (often only consisting of a main building or a block of buildings but given free zone status) which allow foreign investors to retain 100% ownership and grant residency visas to investors and employees and their dependents.

Companies established in free zones can only offer goods and services internationally and within the Free Zone where they operate. However this typically does not hamper software development companies generally and blockchain and crypto companies in particular.

In the zone

The choice of free zone first and foremost depends on the type of activity of your business:

- Crypto-currency related businesses in Dubai, especially those with trading activities that are licensable, are primarily located in the Dubai Multi Commodity Center (DMCC), which as discussed below has been actively encouraging the blockchain and crypto ecosystem.

- Other development work related to distributed ledgers, typically without the need for a regulatory license, is done out of the Dubai Airport Free Zone Authority (DAFZA), the Dubai World Trade Center Authority (DWTCA) and also the Digital Oasis and Dubai International Free Zone Authority (IFZA).

- The Dubai International Financial Centre free zone (DIFC) is arguably the most prestigious but also the most expensive free zone. The DIFC is typically used by financial services providers, including crypto hedge funds, family office and institutional asset managers.

- Abu Dhabi has also made overtures to the crypto space for companies formed in the Abu Dhabi Global Markets (ADGM) jurisdiction, which is a common-law free zone in its own right with proprietary courts (with judges imported from e.g. the UK and Australia) and a super modern corporate registry.

In addition to the type of activity and corresponding license, other factors that may determine your choice of what free zone to incorporate in will include:

- Physical location: some free zones are more like university campuses, some are remote (e.g. Ras Al Khaimah aka as RAK), others are clusters of office towers such as the DMCC which is housed in the Almas Towers, and some are multi-hectare urban areas with prestigious office blocks around international hotels such as the Ritz Carlton and Four Seasons in case of the DIFC.

- Cost: the costs vary widely between free zones with DIFC topping all of them, since a company in DIFC is required to lease its own office space there in what is some of the most expensive real estate in Dubai. Other free zones do no require an office lease (e.g. DFZA) and free zones such as the DMCC do have a local office requirement but are content if you start with the lease of a flexi-desk in an open-plan workspace.

- Finally, free zones have diverging requirements for auditing and bookkeeping, share capital, and even the number of shareholders your free zone company can have.

We consider IFZA the easiest - be it not the cheapest - free zone for the establishment of a company, for a number of reasons:

- Exemption from submitting an annual audit report.

- No requirement for paid-up share capital.

- The ability to apply for up to 3 years of visas for both owners and employees, gives businesses the time and resources to establish themselves in the market.

- No need for a deposit guarantee for employees working in the free zone.

- The option to establish a virtual office, which provides a cost-effective solution for businesses looking to minimise overheads.

- No need to be physically present during the company formation process.

- No need for a No Objection Certificate (NOC) from the current visa sponsor, simplifying the process of changing sponsorship.

The DMCC however is the preferred free zone for crypto-related businesses, including:

- mining facilities operators

- metaverse service providers

- proprietary trading outfits in crypto-commodities

- distributed ledger technology services

- proprietary crypto mining

- NFT marketplaces.

- Any licensable activities regulated by Dubai’s new Virtual Asset Regulatory Authority incl. virtual exchanges, token issuance, custody services, broking and lending, advisory services.

As a result, our first offering in Dubai is for a DMCC free zone company (see Section C below).

Property first

From the above, it can be seen that the decision where to form a company in the UAE is by no means trivial and the tax benefits from being there come with a high price: UAE companies are generally expensive, not only to incorporate but also to maintain, as a result of the high annual business licenses of most free zones.

In addition, regulatory-wise not only has each emirate regulations in areas where there is no federal UAE law, some free zones have their own regulator, e.g. the DIFC is regulated by the Dubai Financial Services Authority (DFSA), whilst the Financial Services Regulatory Authority (FSRA) is the regulator in the Abu Dhabi Global Market (ADGM) zone.

As a result of this patchwork of free zones and regulations, even a Dubai-wide law related to Virtual Assets passed on February 28, 2022 (Law No. 4 of 2022 on the Regulation of Virtual Assets) and its new enforcer via the Dubai Virtual Assets Regulatory Authority (“VARA”) has an uneven application across Dubai, since it excludes the DIFC and may have different implementations within each free zone.

Enough to drive you mad? Otonomos can help you through this maze and guide you towards the optimal setup for your Dubai entity (see our services under Section C below).

In all this, bear in mind that Dubai has always been and to a large extent remains a real estate play, with property still the main game in town: if you earmark ample budget for office spend and - if you decide to work from Dubai - residential property you’ll be well along your way to become an Emirati (which is the UAE-wide name for all inhabitants of the UAE: there is no such thing as a “Dubaian”!).

Crypto next?

At least in its declarations of intent, Dubai has reacted much faster than most other countries when it comes to integrating new technologies and providing the support and infrastructure needed for high tech industries, including in the fields of robotics, healthcare, finance, IT, etc.

These efforts have lead to real results in certain sectors such as healthcare and e-commerce. For instance, with regards to e-commerce, the UAE has created free zones dedicated to support the growth of the e-commerce market in the Middle East and North African (MENA) region. Such free zones offer thousands of square meters of e-commerce logistics units and multi-client warehouses, end-to-end warehousing services like order management systems and streamlined customs clearance processes, and last mile delivery services.

These antecedents make us hopeful that the UAE has understood the promise of decentralized ledger technology, be it that a lot of the early initiatives in crypto are conducted under the auspices and with the blessing of the Emirati authorities.

However, changes in the geopolitical landscape and restrictions on crypto from places such as the U.S. have now put the UAE on the shortlist of many crypto entrepreneurs as a possible base, despite its lack of a startup culture.

Supporting this opportunity, the UAE has moved very early to set up a regulatory framework aimed at attracting talent and companies in the blockchain and crypto space.

For instance, the UAE’s Securities and Commodities Authority (SCA) moved quickly to set up a framework that allows crypto businesses to operate in a number of free zones, perhaps most prominently the DMCC.

Similar regulation was introduced in the leading financial free zones of the DIFC and Abu Dhabi Global Market (ADGM).

In addition, a Crypto Centre was launched at the DMCC with the idea to kickstart an ecosystem of crypto and blockchain entrepreneurs, investors and partners.

Located in the Almas Tower, the DMCC Crypto Centre is Dubai’s leading hub for crypto businesses – aiming to foster growth, collaboration and standards across the global crypto, Web3 and blockchain economy.

The Centre currently counts over 500 crypto firms, making it the largest ecosystem of crypto and blockchain companies in the region and offers a number of facilities, such as a co-working space and access to crypto incubator and accelerator programs that are meant to help entrepreneurs scale their operations.

And just this month, the launch of the Ras Al Khaimah (or RAK) Digital Assets Oasis was announced as “the world's first Free Zone solely dedicated to digital and virtual asset companies innovating in new and emerging sectors of the future including metaverse, blockchain, gaming, NFTs, DAOs, DApp, and other Web3-related businesses.”

Mooning with His Highness

Our intel on the ground indicates that generally clients who made the move to Dubai are happy and that the local crypto community is easy to access.

Only when they have to deal with the local bureaucracy (including trying to set up a company and apply for a visa by themselves) do they find the local administrative process maddening.

For this reason, almost all entrepreneurs who initially DIYd things in Dubai ultimately hand corporate, visa and other admin matters over to service providers.

More generally, whilst Otonomos is by nature skeptical of any government system that lives by the graciousness of a monocrat, the UAE’s Ruler at least does not seem to actively put obstacles in place for crypto entrepreneurs, vs. some legacy jurisdictions that seem bent on making entrepreneurs’ lives more difficult by regulatory overzealousness and enforcement overkill.

B. Setup and costs

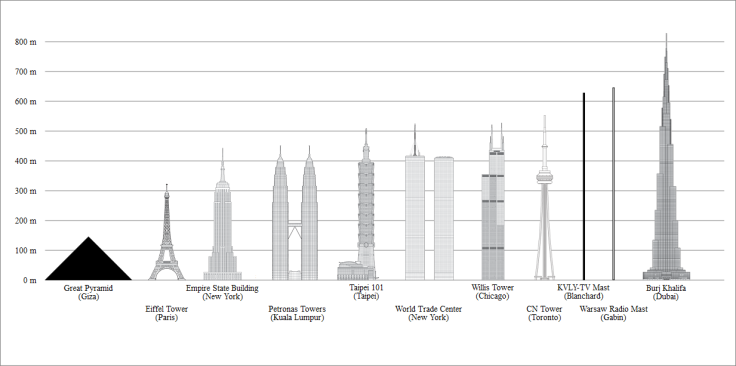

As indicated above, setup cost vary widely across free zones, so the costs below are mid-range between the more startup-oriented free zones and the more institutional ones.

One-time establishment cost

As a rule of thumb expect to pay around US$10,000 onwards as a one-time fee to incorporate your Dubai entity in the DMCC free zone, with the DIFC outdoing all other free zones at around US$24k.

Note that Dubai companies generally do not require capital to be paid up, though depending on the type of activity, crypto companies may need to provide sufficient working capital for 6 - 12 months out, which comes down to the same.

Annual operating license

The above excludes the annual license fee payable to the free zone government, which for the DMCC is just under US$9k/year and just under US$20k/year for the DIFC.

A company license is the most important document to start a business in the UAE. It is a permit to carry out business. The company license mentions all major activities that a company can carry out in UAE.

Establishment card

All of the free zones issue “establishment cards” will allow you to apply for residency in the UAE.

The cards can range between US$500 to US$1k annually per employee. Typically a deposit is due per applicant of around the same amount as the annual visa fee.

Visa application itself including the issuance of a residency permit is a separate process for which Otonomos charges US$5,250 per applicant linked to a DMCC company.

Office space

Some free zones require you to take a lease in the zone’s office space, which can range from a virtual office or a hotdesk in a co-working space to a full proprietary office.

Otonomos’s Minimum Kit in the DMCC includes a flexi-desk for one person which meets the DMCC’s requirement to have a local office there, upgradeable to either a dedicated open-plan desk or a dedicated serviced office. See our full pricing in Section C and do bear in mind what we said above about Dubai being first and foremost a real estate play!

Local licenses

Some activities e.g. the trading of digital assets are subject to local licenses and we will discuss your licensing needs - if any - when we explore your optimal setup.

For instance, in the DMCC a crypto license starts at around US$9,500 and takes approx. 4 weeks to get. Among the usual applicants’ documents and their company formation kit, the license application requires a clean crypto wallet, sufficient business runway of at least 6 to 12 months of operation, and a detailed business plan.

Have company, will travel

As indicated above, Dubai is one of the few jurisdictions that grants visas linked to local companies so its owners, its staff and dependents can physically work from Dubai and become tax residents there.

Dubai tax residency typically far outweighs the company setup and maintenance costs above, as not only will you not be taxed on income and assets from outside Dubai, as a Dubai tax resident, you will also pay zero tax on earnings from Dubai-sourced income and capital gains on locally-held assets such as real-estate or digital assets you hold in e.g. offshore holding companies.

Whilst Dubai is by no means a cheap place to incorporate and operate from, it is arguably the best personal tax regime of any major business location, as it allows you to hold shares and take stakes in companies abroad (both holdings and operational ones) and be exempt from withholdings on dividends payments and capital gains upon realization of profits.

The above regime obviously only applies if you move to Dubai for a long term, or you are out of your home country for a long enough period (generally considered to be at least 1 year), so you qualify as a non-resident in your home country for tax purposes.

6 month stays are generally considered insufficient to extract yourself from your home country and be considered a tax resident in Dubai.

Timing is everything

The timing of when you swap your home tax domicile to Dubai is crucial, as many countries qualify their citizens for tax purposes based on their tax year.

If you spend the most part of the current tax year in your country of domicile, you might be considered a tax resident for that tax year and be taxed on your income for the whole year, regardless of the fact that part of the income for that year was earned in Dubai.

For instance, if you are a UK citizen and UK domiciled, working for a year in Dubai may not be enough to exempt you from your income tax obligations in the UK if that year covers just half of the current tax year and half of the next tax year.

So better to plan your arrival on 6 April, when the new tax year starts in the UK!

As mentioned earlier, to make sure you can lawfully work in Dubai upon arrival, you can add a certain number of visa allocations to your free zone company license, called the ”establishment card”.

Otonomos does that by automatically adding one such card to its Minimum Kit formation package, since without such card you would not be able to get a visa quote.

We provide further packages with 3 quotes so you can also bring over co-founders or have expatriate employees working for your new company in Dubai.

As a general rule, owners of a Dubai free zone company, their dependents and its employees are eligible to apply for a UAE residency visa.

Note however that irrespective of the duration of your stay, the UAE does not offer citizenship, ever.

Expat considerations

Banking

With your residence visa, you will have access to the banking options throughout the UAE, and get priority banking for around US$100,000 in a priority account there which will allow you to easily open personal bank accounts in other locations of the same bank around the world.

Such expat banking on the personal side may also be a shortcut towards a UAE bank account for your local business there. Whilst Gulf banks are generally quite bureaucratic, establishing a private banking relationship first as a resident of Dubai will open a lot more possibilities compared to applying only for a local business account.

Otonomos does however offer a bank account opening service with all major Gulf banks for your DMCC free zone company, irrespective of whether you already have a personal account there.

Foreign ownership and capital repatriation

Previous restrictions related to partial local ownership have been abolished and all free zone companies now offer 100% foreign ownership, however most still have restrictions as to the maximum number of shareholders.

Capital repatriation is allowed at all times in case you wanted to divest your assets from the UAE. This is important as a “rage quite” option for anybody who decides to build their business in the UAE but wonders - as we do - to what degree the UAE will (continue to) tolerate the degree of dissent and subversiveness that often comes with radical innovation but coexists uneasily with more autocratic forms of government.

Connectedness

The UAE is supremely connected with two of what are generally considered some of the best airlines in the world, Emirates and Etihad, offering daily flights to most major destinations around the world from their respective hubs in Dubai and Abu Dhabi.

No need to be in the UAE for the whole year

Absence from the UAE will not rescind your residency (but it may drag you back into the tax net of countries you visit for more than a certain number of days!) which is especially helpful between May and September when the desert heats ups and the temperatures in the UAE become unbearable.

In this context, Otonomos can help with both the company registration and the issuance of establishment cards without requiring you to be physically present in the UAE.

We then arrange an express medical examination (a requirement for the residency visa application) when you step off the plane so we can immediately commence the visa process. Given that most passport holders can stay 30 if not 90 days in the UAE without a visa, you should get your Emirati ID issued on your first visit!

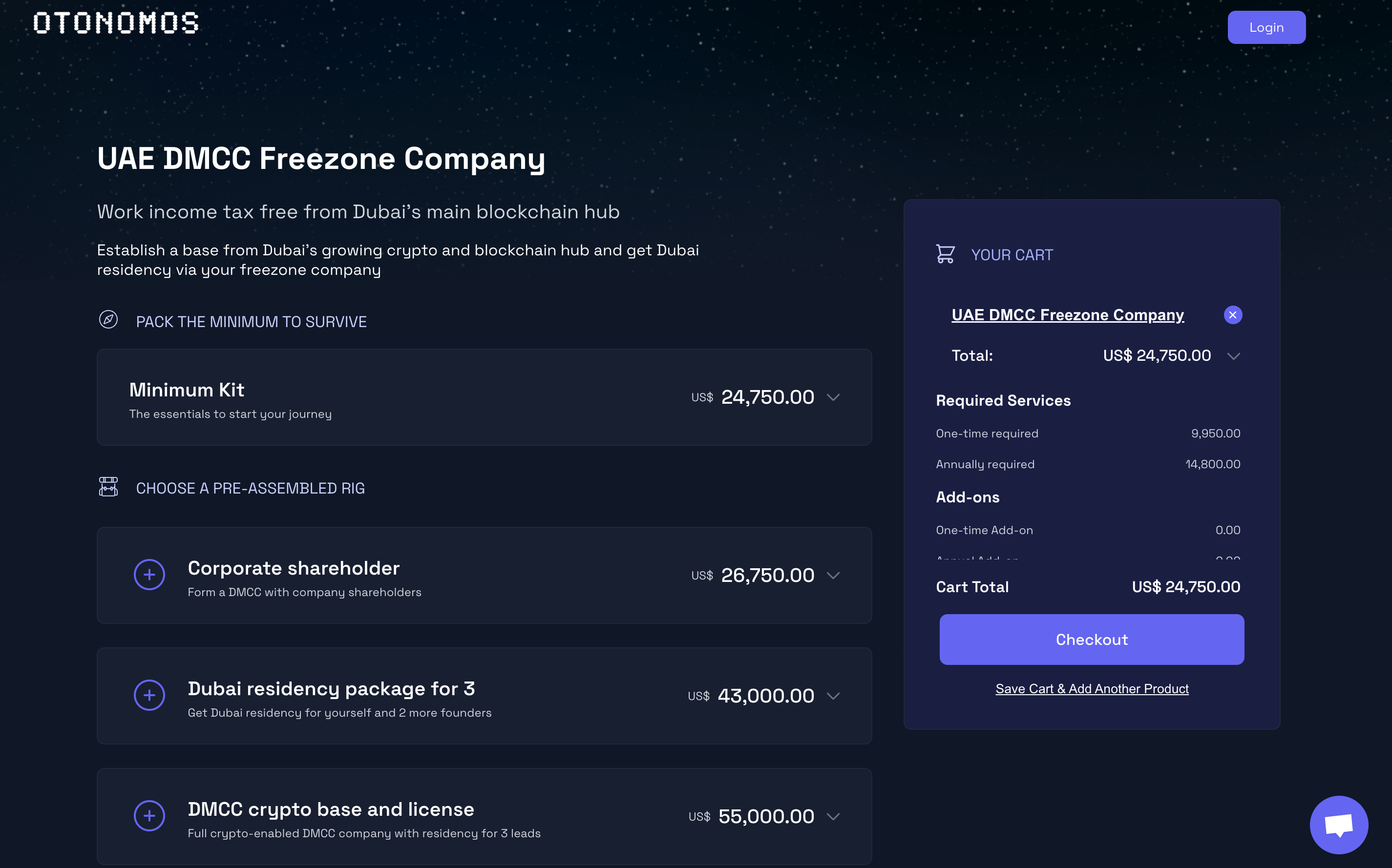

C. Otonomos’ services in the UAE

Dubai feels perhaps a bit of a company bazaar, so when designing our new offering, we wanted to make sure you don’t feel alone in your decision to put a base in place in Dubai.

We have tried to streamline our packages on otonomos.com to cater to common denominator setups but are always happy to calibrate our offering to your needs and quote for your setup offline.

If you do not see your needs reflected in our online DMCC formation kits for online purchase, perhaps the best starting point is a call with us.

Because we feel we share a lot of intel and valuable information in such first call, we charge US$200 to speak to one of our jurisdiction specialists for 30 minutes.

You can book your call here or use the action button at the end of this post.

Minimum Kit

As you would expect from Otonomos, we give total transparency on our fees via our web portal at otonomos.com, which lets you order a Dubai company in the DMCC online and pay in all major crypto or by bank wire or card.

Our Dubai Minimum Kit includes:

- One-time setup cost of US$9,950 for the establishment of a DMCC free zone company with physical shareholders (US$11,950 if you have corporate shareholders in addition or instead of only physical ones).

- Annual maintenance fees of US$ 8,800 including an Establishment Card with one visa quote towards a residency visa application.

- A flexi-desk lease for one person in the DMCC’s Business Centre open-plan workspace for US$ 6,000 per year pre-paid, including all admin fees and setup costs.

The setup time for a DMCC free zone company is usually between 5 to 10 days from receipt of the information we will need from you.

Booster packs and add-ons

You can upgrade the above Minimum Kit with an application for a 2-year residency visa for yourself as the main shareholder for an extra US$1,750.

Or you can go for the pre-assembled Dubai Residency for 3 package which includes the application for 3 residency passes (one-time total of US$5,350) and corresponding dedicated desks for 3 (US$6,000 per person extra per year) so you can scale your business with the necessary infrastructure and fully benefit from the DMCC’s ecosystem.

The full DMCC crypto base and license package then adds the crypto license application for a one-time application fee of US$12,000. With such license, you will be able to conduct regulated crypto activities which in many other places around the world are either expressly ruled out or require a prohibitively costly license which will take 6 months to a year to get.

In the DMCC by contrast, such license is typically issued between 4 to 8 weeks from Otonomos’ submission of your application.

One call does it all

If you’re not ready to order online, Otonomos charges US$200 for an initial 30-mins call to discuss your needs and provide guidance on your optimal setup.

Once you are an Otonomos client, you will have unlimited access to our Support channels (email, website chat, and Telegram DM) and all follow-up calls will be free of charge.

> Schedule an initial call today to get your Dubai setup started.