1. Ethereum is optimism

Attending DevCon restores one’s faith in humanity: most if not all people I met and spoke with work in earnest and with best intent on stuff they believe will help make the world a better place.

Compared to Prague, blockchain hyper-financialization got de-emphasized whilst governance, privacy and social impact received a lot of attention.

Despite the prevalent idealism, some voices such as Pia Mancini warned against the dangers of working on future technologies that help install a new crypto plutocracy.

2. Ethereum is a home for many

The Ethereum community is strong, its visual language is powerful, the soft power is there and its irreverent roots remains intact. Its culture is stronger than many real-world countries.

Despite the momentous achievement of the Merge and its “On top of the mountain” conference slogan, Ethereum didn’t really pad itself on the back.

3. PoS centralization may be temporary but censorship is problematic

There is a not insignificant concern that Ethereum has become more centralized as a result of the high concentration of validators in the hands of centralized exchanges and staking services such as Lido.

I personally believe this may be temporary: there's enough ETH in circulation that isn't staked for non-stakers to stake more and if necessary outstake the centralized validators.

The approx. 14.6 million ETH currently staked only represents about 12% of the 121 million supply. It can be expected that long-term hodlers who aren’t presently staking would stake more of their ETH to counteract any behavior perceived as harmful to the network.

But even without threats to the network, the amount of ETH solo staked will assumedly increase once validators can withdraw their staked ETH. Such withdrawal feature is most likely going to be part of Ethereum’s next upgrade called Shanghai, expected within the next year.

More worryingly is that transactions on Ethereum that involve addresses “tainted” by Tornado Cash wallet addresses that have been sanctioned are increasingly being censored by the big, centralized validators to stay compliant with Office of Foreign Asset Control (OFAC) sanctions.

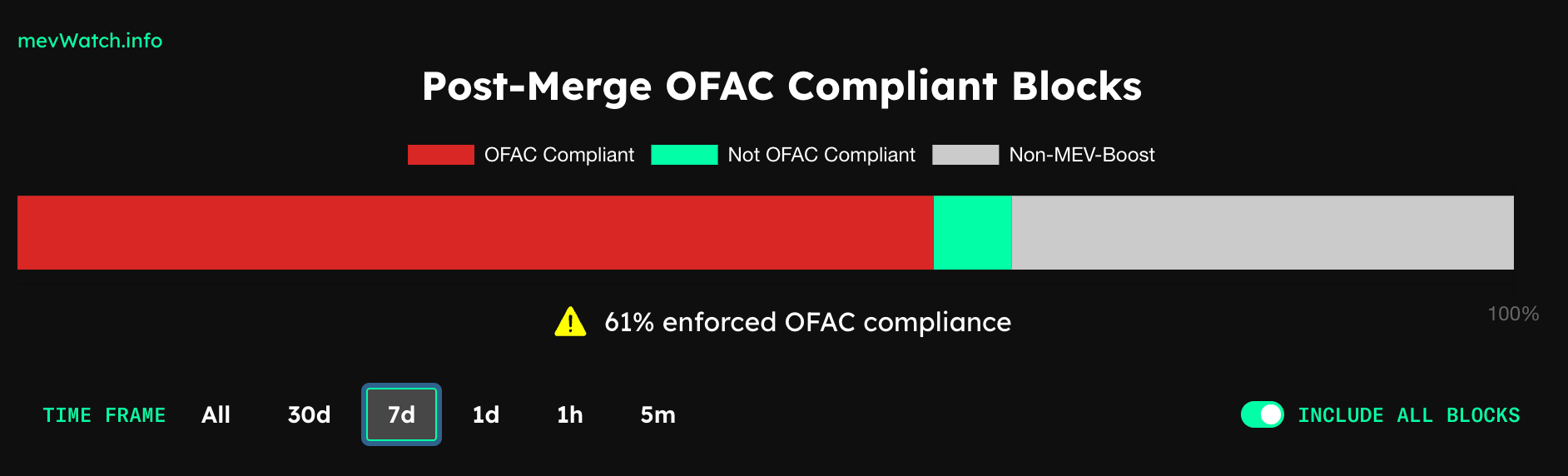

A community tool that keeps track of such censoring by MEV-boost relays (a piece of software that acts as some sort of middleman allowing validators to request blocks from a network of builders) shows that at the time of writing, MEV-boost relays enforced OFAC compliance on 61.2% of all blocks on the Ethereum blockchain.

Even though so far it seems not a single transaction on Ethereum has actually been censored due to OFAC, there is a risk that centralized validators with U.S links omit certain transactions, and a longer-term risk that U.S and other regulators impose KYC, AML or other compliance requirements on users simply staking their ETH (especially if ETH were to be found a security, in which case staking it could become a regulated activity), making the Ethereum blockchain censorable. I see this as one of the most life-threatening risks to Ethereum and other PoS blockchains.

The above ties in with our post on the three clear and present regulatory dangers for crypto further in this issue of The Otonomist.

4. Privacy is next

Relatedly, zero-knowledge (ZK), which allows for shielding of transactions on Ethereum, received outsize attention.

This shows that the community, whilst Ethereum is on a path to further scaling, already has privacy as the next big challenge in its sights.

Secure, private (or at the very least “shieldable”) transactions at scale is the end state for Ethereum, and whilst this goal is clear, the next years will be all about how to get there.

5. Importance of infrastructure

Some developers writing code in the trenches felt that the conference missed deep-dives on key infrastructure they use every day such as IPFS, OpenZeppelin, etc.

Sessions about social impact and governance may have felt high-falutin to those who actually buidl.

Perhaps the Ethereum Foundation can address this need by sponsoring some type of code academies.

6. Latin America brings hope for crypto (and vice versa)

Arguably because the region is typically marked by low levels of societal trust and high levels of corruption combined with generally weak governments, Latin America may become a groundswell for crypto.

Trustless smart contracts solutions are born out of a real need from the region and seek to address tangible societal deficiencies.

In this light, organizing DevCon in Bogotá was a clear statement by the Ethereum Foundation of the importance of growing strong Latin American grassroots. It is a region where a big chunk of the “next billion” Ethereum developers may come from.

Let’s hope Ethereum can soon replace Tron (whose Founder Justin Sun just got made Ambassador to the WTO for Dominica…) as the dominant ledger for crypto to USD transactions in Argentina!

7. Governance is evolving

A total of 20 sessions at DevCon VI were dedicated to “Governance and Coordination”, generally recognizing that we need to move beyond coin voting.

Optimism may be leading the discussion with its bicameral system though by its own admission, a lot is still to be worked out.

OtoCo itself has some clear proposals which we blogged about earlier that seek to improve Web3 governance with a focus on longer-term participation rewards using NFTs.

We expect further iteration on governance models but let’s be wary of a one size fits all design.

8. Public goods funding

A subset of the Governance track discussed new models for funding public goods and Vitalik recently contributed to this live debate in a recent blog post.

We expect the discussion how to remove the pressures from monetization of key shared blockchain infrastructure to gain increased importance, with iteration on various governance models related to how such public goods get funded.

Hope to see you at the next DevCon!