What is paid-up capital?

Switzerland has two types of private companies.

There is the GmbH and the AG. There is no need to know what this stands for, except that the GmbH is the equivalent of a private limited company whilst the AG is typically for companies with a larger shareholder base or companies that are listed on the stock exchange.

As a result of their different nature, they have different capitalization requirements.

The GmbH has to have CHF 20,000 in paid-up capital. The AG requires CHF 100,000 (50,000 in certain circumstances).

As with many civil law countries, this capital requirement reflects a tradition in which companies are required to have a certain capital buffer as proof of their solvency before commencing trading.

No dead weight

As a result, once the capital has been paid up, it can actually be used for the business as long as it is allocated towards a legitimate business purpose. In other words, it is not deadweight capital that has to be on account at all times.

When using fiat money, paid-up capital is required to be deposited in a special bank account. Once the Company is formed, this reserve account then typically converts into the current account for the business.

When using Crypto there is obviously no need for such reserve bank account. This makes the process both easier and more complex.

Crypto is easier and more difficult

Easier in a sense that the paid-up capital can just be shown as sitting in a crypto wallet.

More difficult in that (1) the contents of the wallet has to match the minimum paid-up capital at all times and (2) ownership of the wallet somehow has to be linked to the first shareholder(s) of the company.

Let’s have a look at these two complexifiers in more derail.

The level of crypto assets has to match the minimum capital requirement at all times

The key issue here is that crypto is volatile. Because of the timelag between ringfencing the crypto towards the paid-up capital and the actual formation of the company, in other words its actual filing with the commercial registry in Switzerland, there is a risk that the amount of paid-up capital falls below the minimum capital required.

We therefore typically advise clients to make sure they overfund their wallet. This doesn't do any harm since paid up capital, as mentioned before, can later be used towards legitimate business purposes.

When using fiat, it is easy for the filing agent to just ask for a bank statement that shows the minimum capital has bene paid up.

When using crypto, in principle it should also be easy however, currently the use of the services of an outside auditor is required. This will bring with it some extra costs (typically around CHF 2,000) and a couple of days delay.

Ownership of the wallet has to be linked to the first shareholder(s) of the company.

This auditor will also attest that the wallet containing the paid-up capital is controlled by the first shareholder(s) of the company.

The process below may seem self evident for anybody well versed in crypto however let's remind ourselves that we are dealing here with analogue service providers.

The steps are as follows:

Existence: The auditor first receives the public address of the wallet the company’s founder earmarked for the deposit of the paid-up capital and verifies its balance, typically using bitcoin.com for BTC transactions and Etherscan for all ERC20 assets on Ethereum.

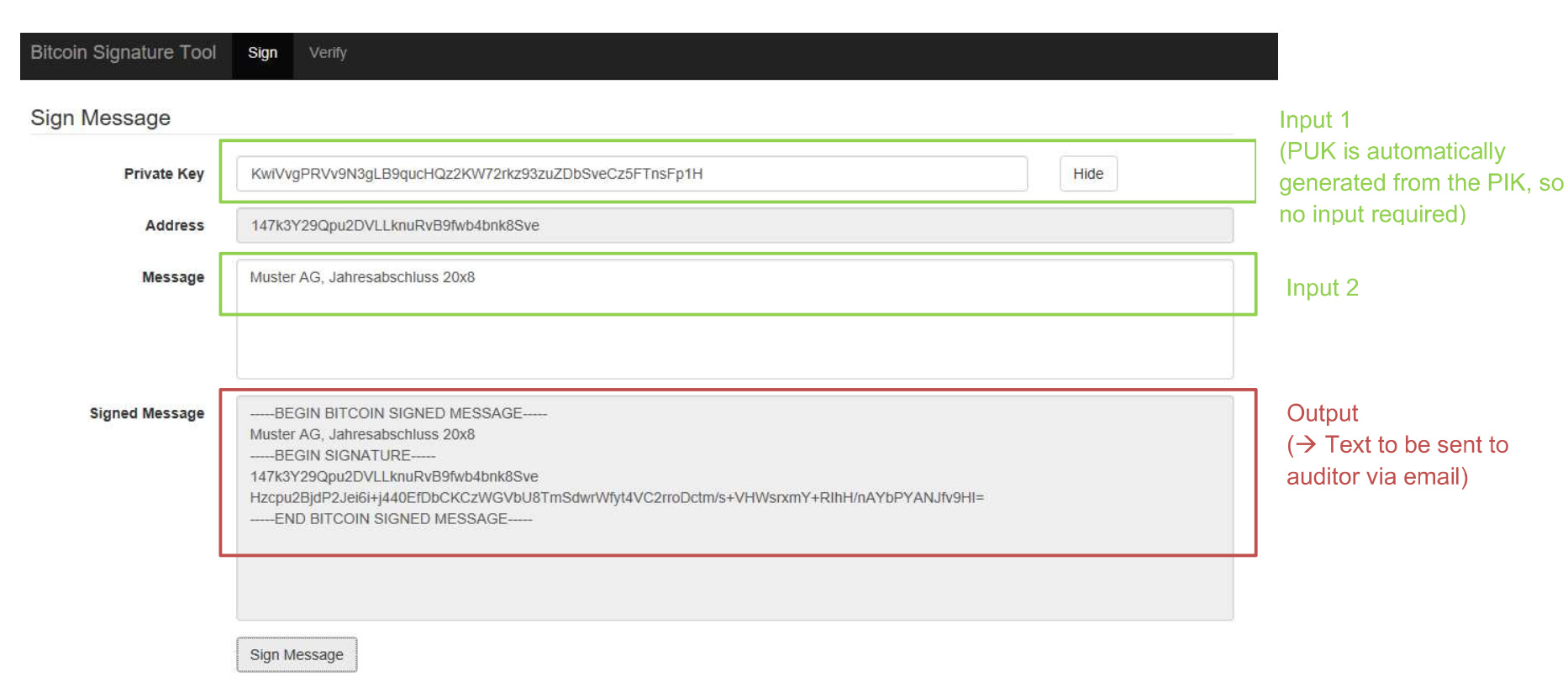

Sign message procedure: The auditor then sends the founder a message to be signed. The message can contain anything but the timing and topic should be clear and it should not be possible for the client to predict it.

The client then signs the message using the private key and sends it to the auditor. This requires a tool in which the private key and the message are entered. Various tools are freely available online.

The auditor will then receive the signed message (orange box below) via email.

The result should broadly look as follows:

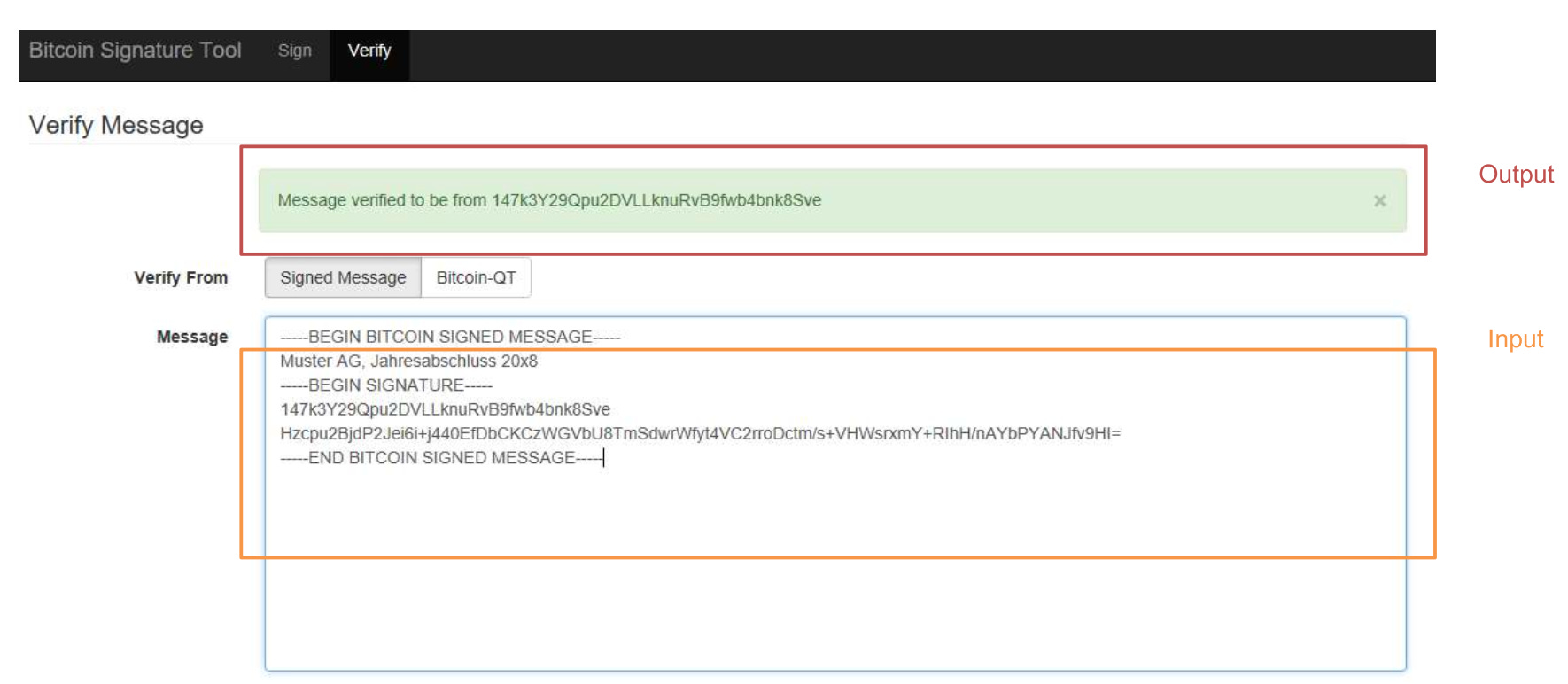

Source: https://reinproject.org/bitcoin-signature-tool/#sign using fictitious data. Finally, the auditor checks that the signature is correct. This is done by entering the same message into a verification tool. The result should look something like this:

Now that the auditor is satisfied that the minimal capital requirement is met and the wallet belongs to the founder of the company, a report will be issued to confirm this and the company can be filed with the Swiss commercial registry.

Otonomos Zug

Otonomos can handle this entire process for you, including the provision of audit services to verify the crypto paid-up capital, the filing of the company at the commercial registry and provision of a registered address and resident Director for your company in Zug.

Our fees are public on our website however please note that the auditor fees are not included as they may vary according to which crypto is used and the number of initial shareholders.

In a typical straightforward set up with one founder, the auditor cost will add CHF 2,000 to your overall setup cost.